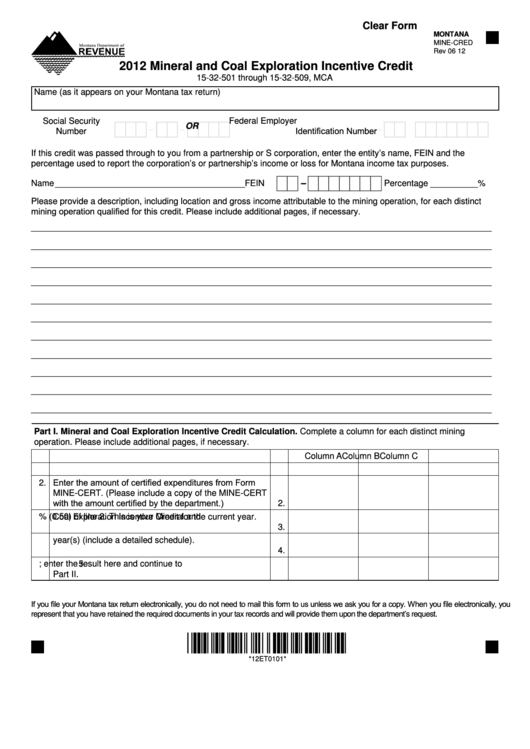

Clear Form

MONTANA

MINE-CRED

Rev 06 12

2012 Mineral and Coal Exploration Incentive Credit

15-32-501 through 15-32-509, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Identification Number

Number

If this credit was passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

percentage used to report the corporation’s or partnership’s income or loss for Montana income tax purposes.

Name ________________________________________ FEIN

Percentage __________ %

-

Please provide a description, including location and gross income attributable to the mining operation, for each distinct

mining operation qualified for this credit. Please include additional pages, if necessary.

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Part I. Mineral and Coal Exploration Incentive Credit Calculation. Complete a column for each distinct mining

operation. Please include additional pages, if necessary.

Column A

Column B

Column C

1. Name of Mining Operation

1.

2. Enter the amount of certified expenditures from Form

MINE-CERT. (Please include a copy of the MINE-CERT

with the amount certified by the department.)

2.

3. Enter 50% (0.50) of line 2. This is your Mineral and

Coal Exploration Incentive Credit for the current year.

3.

4. Enter your credit available for carryforward from prior

year(s) (include a detailed schedule).

4.

5. Add lines 3 and 4; enter the result here and continue to

5.

Part II.

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12ET0101*

*12ET0101*

1

1 2

2 3

3 4

4