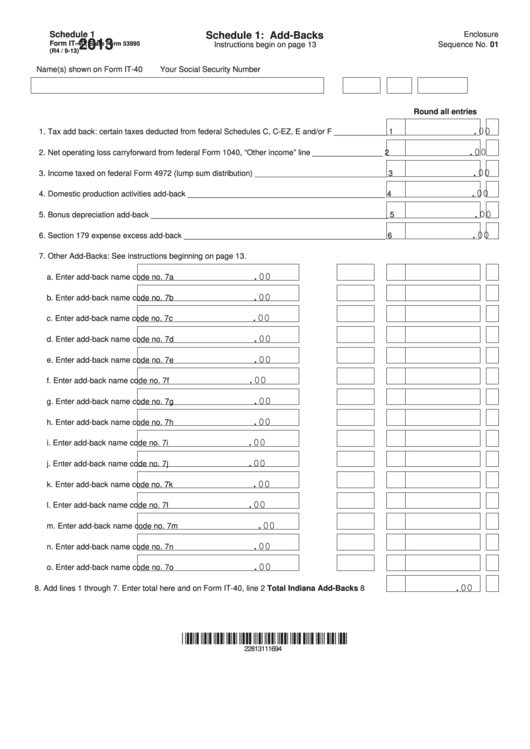

Schedule 1

Schedule 1: Add-Backs

Enclosure

2013

Form IT-40,

State Form 53995

Instructions begin on page 13

Sequence No. 01

(R4 / 9-13)

Name(s) shown on Form IT-40

Your Social Security Number

Round all entries

.00

1. Tax add back: certain taxes deducted from federal Schedules C, C-EZ, E and/or F ____________

1

.00

2. Net operating loss carryforward from federal Form 1040, “Other income” line ________________

2

.00

3. Income taxed on federal Form 4972 (lump sum distribution) ______________________________

3

.00

4. Domestic production activities add-back _____________________________________________

4

.00

5. Bonus depreciation add-back ______________________________________________________

5

.00

6. Section 179 expense excess add-back ______________________________________________

6

7. Other Add-Backs: See instructions beginning on page 13.

.00

a. Enter add-back name

code no.

7a

.00

b. Enter add-back name

code no.

7b

.00

c. Enter add-back name

code no.

7c

.00

d. Enter add-back name

code no.

7d

.00

e. Enter add-back name

code no.

7e

.00

f. Enter add-back name

code no.

7f

.00

g. Enter add-back name

code no.

7g

.00

h. Enter add-back name

code no.

7h

.00

i. Enter add-back name

code no.

7i

.00

j. Enter add-back name

code no.

7j

.00

k. Enter add-back name

code no.

7k

.00

l. Enter add-back name

code no.

7l

.00

m. Enter add-back name

code no.

7m

.00

n. Enter add-back name

code no.

7n

.00

o. Enter add-back name

code no.

7o

.00

8. Add lines 1 through 7. Enter total here and on Form IT-40, line 2

Total Indiana Add-Backs

8

22813111694

1

1