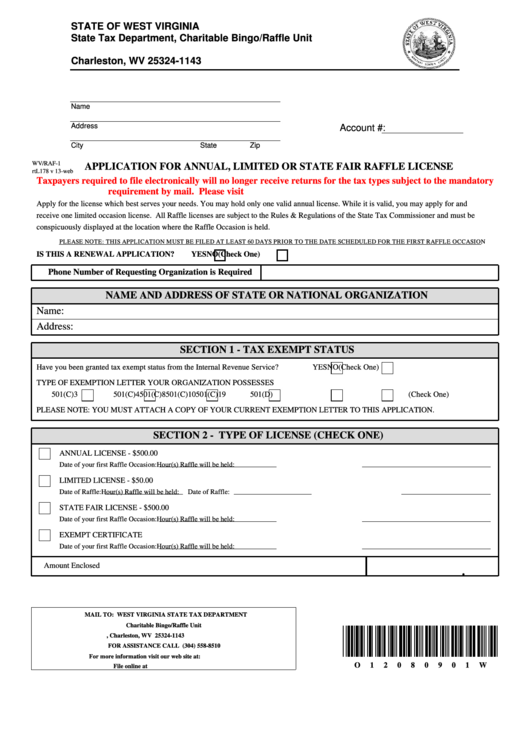

Form Wv/raf-1 - Application For Annual, Limited Or State Fair Raffle License

ADVERTISEMENT

STATE OF WEST VIRGINIA

State Tax Department, Charitable Bingo/Raffle Unit

P.O. Box 1143

Charleston, WV 25324-1143

Name

Address

Account #:

City

State

Zip

WV/RAF-1

APPLICATION FOR ANNUAL, LIMITED OR STATE FAIR RAFFLE LICENSE

rtL178 v 13-web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory

requirement by mail. Please visit for additional information.

Apply for the license which best serves your needs. You may hold only one valid annual license. While it is valid, you may apply for and

receive one limited occasion license. All Raffle licenses are subject to the Rules & Regulations of the State Tax Commissioner and must be

conspicuously displayed at the location where the Raffle Occasion is held.

PLEASE NOTE: THIS APPLICATION MUST BE FILED AT LEAST 60 DAYS PRIOR TO THE DATE SCHEDULED FOR THE FIRST RAFFLE OCCASION

IS THIS A RENEWAL APPLICATION?

YES

NO

(Check One)

Phone Number of Requesting Organization is Required

NAME AND ADDRESS OF STATE OR NATIONAL ORGANIZATION

Name:

Address:

SECTION 1 - TAX EXEMPT STATUS

Have you been granted tax exempt status from the Internal Revenue Service?

YES

NO

(Check One)

TYPE OF EXEMPTION LETTER YOUR ORGANIZATION POSSESSES

501(C)3

501(C)4

501(C)8

501(C)10

501(C)19

501(D)

(Check One)

PLEASE NOTE: YOU MUST ATTACH A COPY OF YOUR CURRENT EXEMPTION LETTER TO THIS APPLICATION.

SECTION 2 - TYPE OF LICENSE (CHECK ONE)

ANNUAL LICENSE - $500.00

Date of your first Raffle Occasion:

Hour(s) Raffle will be held:

LIMITED LICENSE - $50.00

Date of Raffle:

Date of Raffle:

Hour(s) Raffle will be held:

STATE FAIR LICENSE - $500.00

Date of your first Raffle Occasion:

Hour(s) Raffle will be held:

EXEMPT CERTIFICATE

Date of your first Raffle Occasion:

Hour(s) Raffle will be held:

Amount Enclosed

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Charitable Bingo/Raffle Unit

P.O. Box 1143, Charleston, WV 25324-1143

FOR ASSISTANCE CALL (304) 558-8510

For more information visit our web site at:

O

1

2

0

8

0

9

0

1

W

File online at https://mytaxes.wvtax.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3