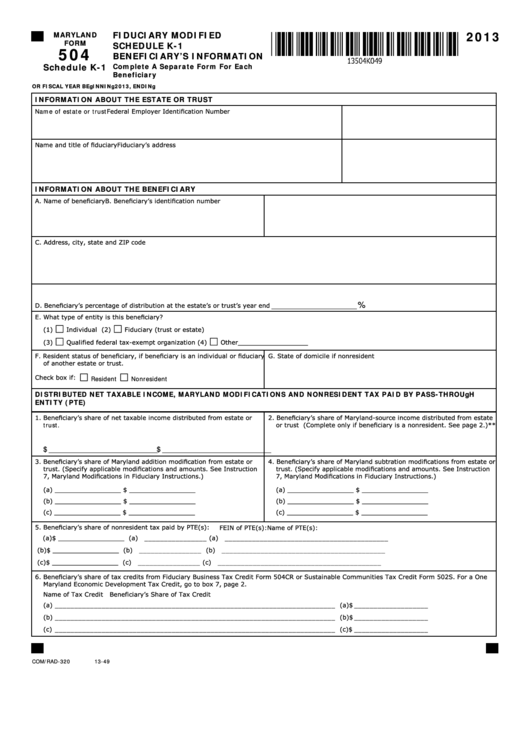

2013

MARYLAND

FIDUCIARY MODIFIED

FORM

SCHEDULE K-1

504

BENEFICIARY’S INFORMATION

Schedule K-1

Complete A Separate Form For Each

Beneficiary

OR FISCAL YEAR BEgINNINg

2013, ENDINg

INFORMATION ABOUT THE ESTATE OR TRUST

Name of estate or trust

Federal Employer Identification Number

Name and title of fiduciary

Fiduciary’s address

INFORMATION ABOUT THE BENEFICIARY

A. Name of beneficiary

B. Beneficiary’s identification number

C. Address, city, state and ZIP code

%

D. Beneficiary’s percentage of distribution at the estate’s or trust’s year end

E. What type of entity is this beneficiary?

£

£

(1)

Individual

(2)

Fiduciary (trust or estate)

£

£

(3)

Qualified federal tax-exempt organization

(4)

Other__________________

F. Resident status of beneficiary, if beneficiary is an individual or fiduciary

G. State of domicile if nonresident

of another estate or trust.

£

£

Check box if:

Resident

Nonresident

DISTRIBUTED NET TAXABLE INCOME, MARYLAND MODIFICATIONS AND NONRESIDENT TAX PAID BY PASS-THROUgH

ENTITY (PTE)

1. Beneficiary’s share of net taxable income distributed from estate or

2. Beneficiary’s share of Maryland-source income distributed from estate

trust.

or trust (Complete only if beneficiary is a nonresident. See page 2.)**

$ __ _ _ __ _ __ _ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ __ _ _ __ _ _ _ _

$ __ __ __ __ __ ___ __ __ __ __ __ __ __ ___ __ __ __

3. Beneficiary’s share of Maryland addition modification from estate or

4. Beneficiary’s share of Maryland subtration modifications from estate or

trust. (Specify applicable modifications and amounts. See Instruction

trust. (Specify applicable modifications and amounts. See Instruction

7, Maryland Modifications in Fiduciary Instructions.)

7, Maryland Modifications in Fiduciary Instructions.)

(a) _________________

$ _________________

(a) _________________

$ _________________

(b) _________________

$ _________________

(b) _________________

$ _________________

(c) _________________

$ _________________

(c) _________________

$ _________________

5. Beneficiary’s share of nonresident tax paid by PTE(s):

FEIN of PTE(s):

Name of PTE(s):

(a)$ _________________

(a) ________________

(a)

__________________________________________

(b)$ _________________

(b) ________________

(b)

__________________________________________

(c)$ _________________

(c) ________________

(c)

__________________________________________

6. Beneficiary’s share of tax credits from Fiduciary Business Tax Credit Form 504CR or Sustainable Communities Tax Credit Form 502S. For a One

Maryland Economic Development Tax Credit, go to box 7, page 2.

Name of Tax Credit

Beneficiary’s Share of Tax Credit

(a) ________________________________________________________________________

(a)$ ___________________

(b) ________________________________________________________________________

(b)$ ___________________

(c) ________________________________________________________________________

(c)$ ___________________

COM/RAD-320

13-49

1

1 2

2 3

3