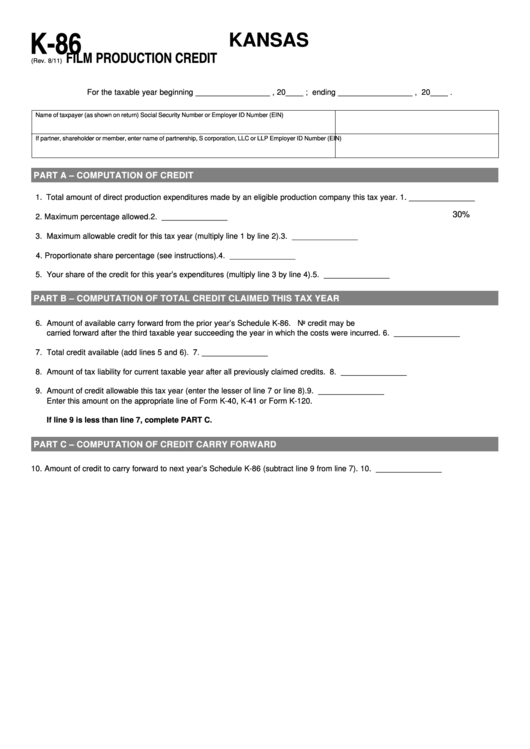

K-86

KANSAS

FILM PRODUCTION CREDIT

(Rev. 8/11)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – COMPUTATION OF CREDIT

1. Total amount of direct production expenditures made by an eligible production company this tax year.

1. _______________

30%

2. Maximum percentage allowed.

2. _______________

3. Maximum allowable credit for this tax year (multiply line 1 by line 2).

3. _______________

4. Proportionate share percentage (see instructions).

4. _______________

5. Your share of the credit for this year’s expenditures (multiply line 3 by line 4).

5. _______________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

6. Amount of available carry forward from the prior year’s Schedule K-86. N o credit may be

carried forward after the third taxable year succeeding the year in which the costs were incurred.

6. _______________

7. Total credit available (add lines 5 and 6).

7. _______________

8. Amount of tax liability for current taxable year after all previously claimed credits.

8. _______________

9. Amount of credit allowable this tax year (enter the lesser of line 7 or line 8).

9. _______________

Enter this amount on the appropriate line of Form K-40, K-41 or Form K-120.

If line 9 is less than line 7, complete PART C.

PART C – COMPUTATION OF CREDIT CARRY FORWARD

10. Amount of credit to carry forward to next year’s Schedule K-86 (subtract line 9 from line 7).

10. _______________

1

1 2

2