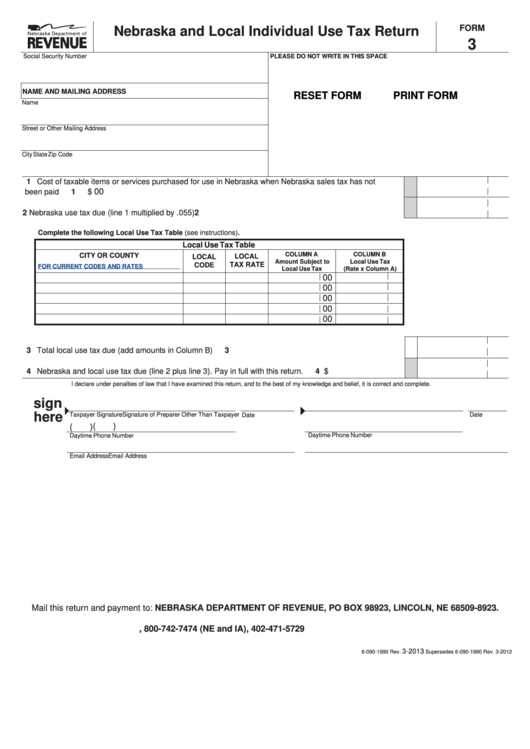

FORM

Nebraska and Local Individual Use Tax Return

3

PLEASE DO NOT WRITE IN THIS SPACE

Social Security Number

NAME AND MAILING ADDRESS

RESET FORM

PRINT FORM

Name

Street or Other Mailing Address

City

State

Zip Code

1 Cost of taxable items or services purchased for use in Nebraska when Nebraska sales tax has not

00

been paid ......................................................................................................................................................

1 $

2 Nebraska use tax due (line 1 multiplied by .055) ..........................................................................................

2

Complete the following Local Use Tax Table (see instructions).

Local Use Tax Table

COLUMN A

COLUMN B

CITY OR COUNTY

LOCAL

LOCAL

Amount Subject to

Local Use Tax

TAX RATE

CODE

CLICK HERE FOR CURRENT CODES AND RATES

Local Use Tax

(Rate x Column A)

00

00

00

00

00

3 Total local use tax due (add amounts in Column B) .....................................................................................

3

4 Nebraska and local use tax due (line 2 plus line 3). Pay in full with this return. ............................................

4 $

I declare under penalties of law that I have examined this return, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Taxpayer Signature

Signature of Preparer Other Than Taxpayer

Date

Date

(

)

(

)

Daytime Phone Number

Daytime Phone Number

Email Address

Email Address

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98923, LINCOLN, NE 68509-8923.

, 800-742-7474 (NE and IA), 402-471-5729

3-2013

6-090-1990 Rev.

Supersedes 6-090-1990 Rev. 3-2012

1

1 2

2