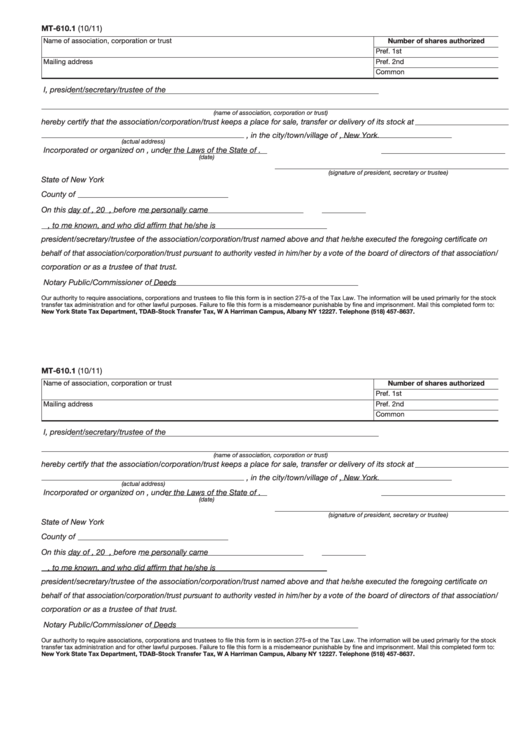

MT-610.1 (10/11)

Name of association, corporation or trust

Number of shares authorized

Pref. 1st

Mailing address

Pref. 2nd

Common

I,

president/secretary/trustee of the

(name of association, corporation or trust)

hereby certify that the association/corporation/trust keeps a place for sale, transfer or delivery of its stock at

, in the city/town/village of

, New York.

(actual address)

Incorporated or organized on

, under the Laws of the State of

.

(date)

(signature of president, secretary or trustee)

State of New York

County of

On this

day of

, 20

, before me personally came

, to me known, and who did affirm that he/she is

president/secretary/trustee of the association/corporation/trust named above and that he/she executed the foregoing certificate on

behalf of that association/corporation/trust pursuant to authority vested in him/her by a vote of the board of directors of that association/

corporation or as a trustee of that trust.

Notary Public/Commissioner of Deeds

Our authority to require associations, corporations and trustees to file this form is in section 275-a of the Tax Law. The information will be used primarily for the stock

transfer tax administration and for other lawful purposes. Failure to file this form is a misdemeanor punishable by fine and imprisonment. Mail this completed form to:

New York State Tax Department, TDAB-Stock Transfer Tax, W A Harriman Campus, Albany NY 12227. Telephone (518) 457-8637.

MT-610.1 (10/11)

Name of association, corporation or trust

Number of shares authorized

Pref. 1st

Mailing address

Pref. 2nd

Common

I,

president/secretary/trustee of the

(name of association, corporation or trust)

hereby certify that the association/corporation/trust keeps a place for sale, transfer or delivery of its stock at

, in the city/town/village of

, New York.

(actual address)

Incorporated or organized on

, under the Laws of the State of

.

(date)

(signature of president, secretary or trustee)

State of New York

County of

On this

day of

, 20

, before me personally came

, to me known, and who did affirm that he/she is

president/secretary/trustee of the association/corporation/trust named above and that he/she executed the foregoing certificate on

behalf of that association/corporation/trust pursuant to authority vested in him/her by a vote of the board of directors of that association/

corporation or as a trustee of that trust.

Notary Public/Commissioner of Deeds

Our authority to require associations, corporations and trustees to file this form is in section 275-a of the Tax Law. The information will be used primarily for the stock

transfer tax administration and for other lawful purposes. Failure to file this form is a misdemeanor punishable by fine and imprisonment. Mail this completed form to:

New York State Tax Department, TDAB-Stock Transfer Tax, W A Harriman Campus, Albany NY 12227. Telephone (518) 457-8637.

1

1