Form Ft-420 - Refund Application For Farmers Purchasing Motor Fuel

ADVERTISEMENT

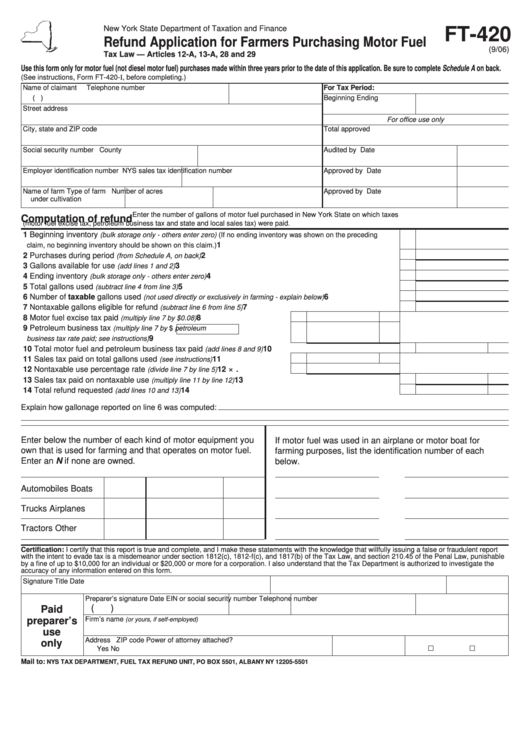

New York State Department of Taxation and Finance

FT-420

Refund Application for Farmers Purchasing Motor Fuel

(9/06)

Tax Law — Articles 12-A, 13-A, 28 and 29

Use this form only for motor fuel (not diesel motor fuel) purchases made within three years prior to the date of this application. Be sure to complete Schedule A on back.

(See instructions, Form FT‑420‑I, before completing.)

Name of claimant

Telephone number

For Tax Period:

(

)

Beginning

Ending

Street address

For office use only

City, state and ZIP code

Total approved

Social security number

County

Audited by

Date

Employer identification number

NYS sales tax identification number

Approved by

Date

Name of farm

Type of farm

Number of acres

Approved by

Date

under cultivation

Enter the number of gallons of motor fuel purchased in New York State on which taxes

Computation of refund

(motor fuel excise tax, petroleum business tax and state and local sales tax) were paid.

1 Beginning inventory

(bulk storage only - others enter zero) (If no ending inventory was shown on the preceding

...........................................................................

1

claim, no beginning inventory should be shown on this claim.)

2 Purchases during period

......................................................................................

2

(from Schedule A, on back)

3 Gallons available for use

..................................................................................................

3

(add lines 1 and 2)

4 Ending inventory

....................................................................................

4

(bulk storage only - others enter zero)

5 Total gallons used

.................................................................................................

5

(subtract line 4 from line 3)

6 Number of taxable gallons used

..............................

6

(not used directly or exclusively in farming - explain below)

7 Nontaxable gallons eligible for refund

...................................................................

7

(subtract line 6 from line 5)

8 Motor fuel excise tax paid

.......................................

8

(multiply line 7 by $0.08)

9 Petroleum business tax

(multiply line 7 by $

petroleum

........................................................

9

business tax rate paid; see instructions)

10 Total motor fuel and petroleum business tax paid

............................................................

10

(add lines 8 and 9)

11 Sales tax paid on total gallons used

................................. 11

(see instructions)

.

×

12 Nontaxable use percentage rate

............................... 12

(divide line 7 by line 5)

13 Sales tax paid on nontaxable use

.........................................................................

13

(multiply line 11 by line 12)

14 Total refund requested

..................................................................................................

14

(add lines 10 and 13)

Explain how gallonage reported on line 6 was computed:

Enter below the number of each kind of motor equipment you

If motor fuel was used in an airplane or motor boat for

own that is used for farming and that operates on motor fuel.

farming purposes, list the identification number of each

Enter an N if none are owned.

below.

Automobiles

Boats

Trucks

Airplanes

Tractors

Other

Certification: I certify that this report is true and complete, and I make these statements with the knowledge that willfully issuing a false or fraudulent report

with the intent to evade tax is a misdemeanor under section 1812(c), 1812‑f(c), and 1817(b) of the Tax Law, and section 210.45 of the Penal Law, punishable

by a fine of up to $10,000 for an individual or $20,000 or more for a corporation. I also understand that the Tax Department is authorized to investigate the

accuracy of any information entered on this form.

Signature

Title

Date

Preparer’s signature

Date

EIN or social security number

Telephone number

(

)

Paid

Firm’s name

preparer’s

(or yours, if self-employed)

use

Address

ZIP code

Power of attorney attached?

only

Yes

No

Mail to:

NYS TAX DEPARTMENT, FUEL TAX REFUND UNIT, PO BOX 5501, ALBANY NY 12205-5501

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2