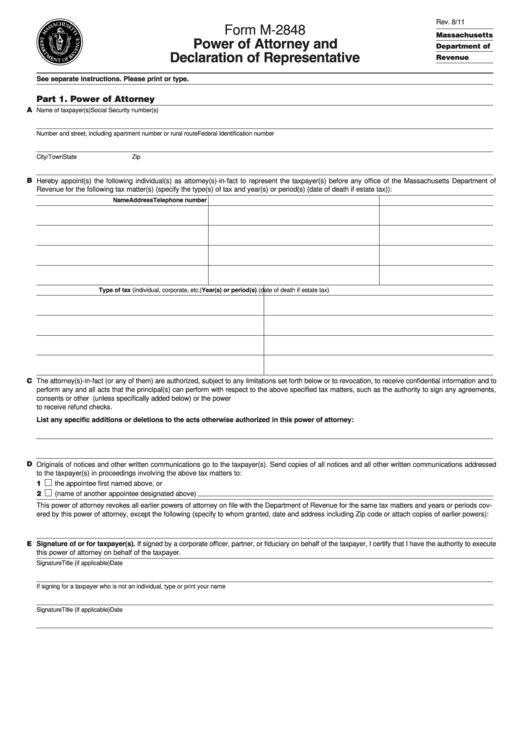

Form M-2848 - Power Of Attorney And Declaration Of Representative

ADVERTISEMENT

Rev. 8/11

Form M-2848

Massachusetts

Power of Attorney and

Department of

Declaration of Representative

Revenue

See separate instructions. Please print or type.

Part 1. Power of Attorney

A

Name of taxpayer(s)

Social Security number(s)

Number and street, including apartment number or rural route

Federal Identification number

City/Town

State

Zip

B

Hereby appoint(s) the following individual(s) as attorney(s)-in-fact to represent the taxpayer(s) before any office of the Massachusetts Department of

Revenue for the following tax matter(s) (specify the type(s) of tax and year(s) or period(s) (date of death if estate tax)):

Name

Address

Telephone number

Type of tax (individual, corporate, etc.)

Year(s) or period(s) (date of death if estate tax)

C

The attorney(s)-in-fact (or any of them) are authorized, subject to any limitations set forth below or to revocation, to receive confidential information and to

perform any and all acts that the principal(s) can perform with respect to the above specified tax matters, such as the authority to sign any agreements,

consents or other documents.The authority does not include the power to substitute another representative (unless specifically added below) or the power

to receive refund checks.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

D

Originals of notices and other written communications go to the taxpayer(s). Send copies of all notices and all other written communications addressed

to the taxpayer(s) in proceedings involving the above tax matters to:

1

the appointee first named above, or

2

(name of another appointee designated above)

This power of attorney revokes all earlier powers of attorney on file with the Department of Revenue for the same tax matters and years or periods cov-

ered by this power of attorney, except the following (specify to whom granted, date and address including Zip code or attach copies of earlier powers):

E

Signature of or for taxpayer(s). If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute

this power of attorney on behalf of the taxpayer.

Signature

Title (if applicable)

Date

If signing for a taxpayer who is not an individual, type or print your name

Signature

Title (if applicable)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3