Form Ft-1001 - Exemption Certificate For Diesel Motor Fuel Interdistributor Transactions

ADVERTISEMENT

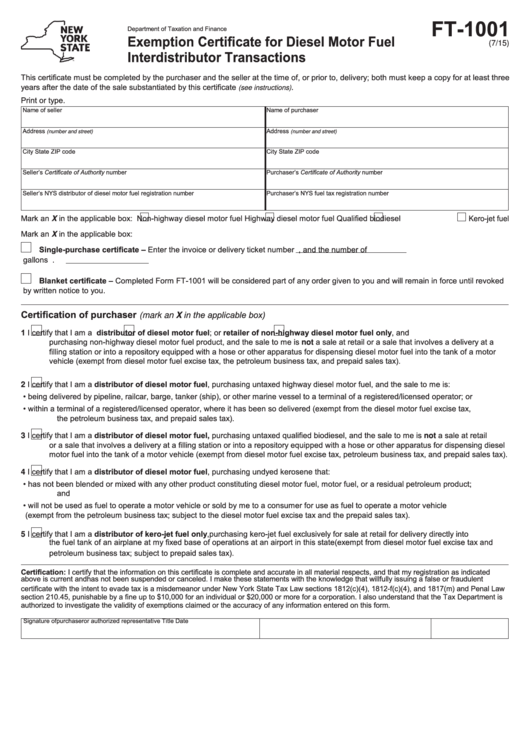

FT-1001

Department of Taxation and Finance

Exemption Certificate for Diesel Motor Fuel

(7/15)

Interdistributor Transactions

This certificate must be completed by the purchaser and the seller at the time of, or prior to, delivery; both must keep a copy for at least three

years after the date of the sale substantiated by this certificate

.

(see instructions)

Print or type.

Name of seller

Name of purchaser

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Seller’s Certificate of Authority number

Purchaser’s Certificate of Authority number

Seller’s NYS distributor of diesel motor fuel registration number

Purchaser’s NYS fuel tax registration number

Mark an X in the applicable box:

Non-highway diesel motor fuel

Highway diesel motor fuel

Qualified biodiesel

Kero-jet fuel

Mark an X in the applicable box:

Single-purchase certificate – Enter the invoice or delivery ticket number

, and the number of

gallons

.

Blanket certificate – Completed Form FT-1001 will be considered part of any order given to you and will remain in force until revoked

by written notice to you.

Certification of purchaser

(mark an X in the applicable box)

1

I certify that I am a

distributor of diesel motor fuel; or

retailer of non-highway diesel motor fuel only, and

purchasing non-highway diesel motor fuel product, and the sale to me is not a sale at retail or a sale that involves a delivery at a

filling station or into a repository equipped with a hose or other apparatus for dispensing diesel motor fuel into the tank of a motor

vehicle (exempt from diesel motor fuel excise tax, the petroleum business tax, and prepaid sales tax).

I certify that I am a distributor of diesel motor fuel, purchasing untaxed highway diesel motor fuel, and the sale to me is:

2

• being delivered by pipeline, railcar, barge, tanker (ship), or other marine vessel to a terminal of a registered/licensed operator; or

• within a terminal of a registered/licensed operator, where it has been so delivered (exempt from the diesel motor fuel excise tax,

the petroleum business tax, and prepaid sales tax).

I certify that I am a distributor of diesel motor fuel, purchasing untaxed qualified biodiesel, and the sale to me is not a sale at retail

3

or a sale that involves a delivery at a filling station or into a repository equipped with a hose or other apparatus for dispensing diesel

motor fuel into the tank of a motor vehicle (exempt from diesel motor fuel excise tax, petroleum business tax, and prepaid sales tax).

I certify that I am a distributor of diesel motor fuel, purchasing undyed kerosene that:

4

• has not been blended or mixed with any other product constituting diesel motor fuel, motor fuel, or a residual petroleum product;

and

• will not be used as fuel to operate a motor vehicle or sold by me to a consumer for use as fuel to operate a motor vehicle

(exempt from the petroleum business tax; subject to the diesel motor fuel excise tax and the prepaid sales tax).

I certify that I am a distributor of kero-jet fuel only, purchasing kero-jet fuel exclusively for sale at retail for delivery directly into

5

the fuel tank of an airplane at my fixed base of operations at an airport in this state (exempt from diesel motor fuel excise tax and

petroleum business tax; subject to prepaid sales tax).

Certification: I certify that the information on this certificate is complete and accurate in all material respects, and that my registration as indicated

above is current and has not been suspended or canceled. I make these statements with the knowledge that willfully issuing a false or fraudulent

certificate with the intent to evade tax is a misdemeanor under New York State Tax Law sections 1812(c)(4), 1812-f(c)(4), and 1817(m) and Penal Law

section 210.45, punishable by a fine up to $10,000 for an individual or $20,000 or more for a corporation. I also understand that the Tax Department is

authorized to investigate the validity of exemptions claimed or the accuracy of any information entered on this form.

Signature of purchaser or authorized representative

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2