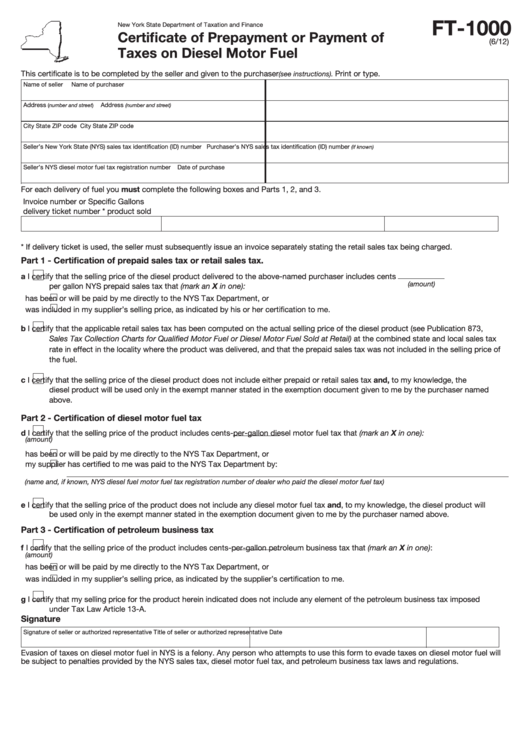

Form Ft-1000 - Certificate Of Prepayment Or Payment Of Taxes On Diesel Motor Fuel

ADVERTISEMENT

FT-1000

New York State Department of Taxation and Finance

Certificate of Prepayment or Payment of

(6/12)

Taxes on Diesel Motor Fuel

This certificate is to be completed by the seller and given to the purchaser

Print or type.

(see instructions).

Name of seller

Name of purchaser

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Seller’s New York State (NYS) sales tax identification (ID) number

Purchaser’s NYS sales tax identification (ID) number

(if known)

Seller’s NYS diesel motor fuel tax registration number

Date of purchase

For each delivery of fuel you must complete the following boxes and Parts 1, 2, and 3.

Invoice number or

Specific

Gallons

delivery ticket number *

product

sold

* If delivery ticket is used, the seller must subsequently issue an invoice separately stating the retail sales tax being charged.

Part 1 - Certification of prepaid sales tax or retail sales tax.

a

I certify that the selling price of the diesel product delivered to the above-named purchaser includes

cents

(amount)

per gallon NYS prepaid sales tax that (mark an X in one):

has been or will be paid by me directly to the NYS Tax Department, or

was included in my supplier’s selling price, as indicated by his or her certification to me.

b

I certify that the applicable retail sales tax has been computed on the actual selling price of the diesel product (see Publication 873,

Sales Tax Collection Charts for Qualified Motor Fuel or Diesel Motor Fuel Sold at Retail) at the combined state and local sales tax

rate in effect in the locality where the product was delivered, and that the prepaid sales tax was not included in the selling price of

the fuel.

c

I certify that the selling price of the diesel product does not include either prepaid or retail sales tax and, to my knowledge, the

diesel product will be used only in the exempt manner stated in the exemption document given to me by the purchaser named

above.

Part 2 - Certification of diesel motor fuel tax

d

cents-per-gallon diesel motor fuel tax that (mark an X in one):

I certify that the selling price of the product includes

(amount)

has been or will be paid by me directly to the NYS Tax Department, or

my supplier has certified to me was paid to the NYS Tax Department by:

(name and, if known, NYS diesel fuel motor fuel tax registration number of dealer who paid the diesel motor fuel tax)

e

I certify that the selling price of the product does not include any diesel motor fuel tax and, to my knowledge, the diesel product will

be used only in the exempt manner stated in the exemption document given to me by the purchaser named above.

Part 3 - Certification of petroleum business tax

f

I certify that the selling price of the product includes

cents-per-gallon petroleum business tax that (mark an X in one):

(amount)

has been or will be paid by me directly to the NYS Tax Department, or

was included in my supplier’s selling price, as indicated by the supplier’s certification to me.

g

I certify that my selling price for the product herein indicated does not include any element of the petroleum business tax imposed

under Tax Law Article 13-A.

Signature

Signature of seller or authorized representative

Title of seller or authorized representative

Date

Evasion of taxes on diesel motor fuel in NYS is a felony. Any person who attempts to use this form to evade taxes on diesel motor fuel will

be subject to penalties provided by the NYS sales tax, diesel motor fuel tax, and petroleum business tax laws and regulations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2