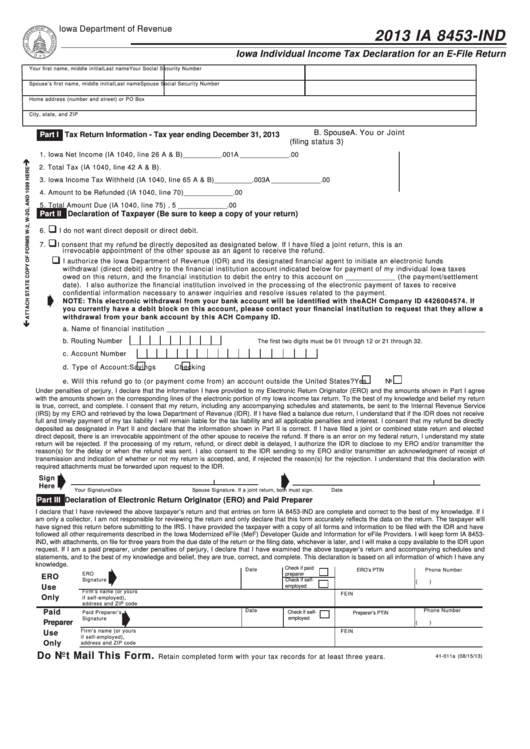

Form Ia 8453-Ind - Iowa Individual Income Tax Declaration For An E-File Return - 2013

ADVERTISEMENT

Iowa Department of Revenue

2013 IA 8453-IND

Iowa Individual Income Tax Declaration for an E-File Return

Your first name, middle initial

Last name

Your Social Security Number

Spouse’s first name, middle initial

Last name

Spouse Social Security Number

Home address (number and street) or PO Box

City, state, and ZIP

B. Spouse

A. You or Joint

Part I

Tax Return Information - Tax year ending December 31, 2013

(filing status 3)

1. Iowa Net Income (IA 1040, line 26 A & B) ............................................................................. 1B __________ .00

1A _____________ .00

2. Total Tax (IA 1040, line 42 A & B) .......................................................................................... 2B __________ .00

2A _____________ .00

3. Iowa Income Tax Withheld (IA 1040, line 65 A & B) ............................................................ 3B __________ .00

3A _____________ .00

4. Amount to be Refunded (IA 1040, line 70) ....................................................................................................................... 4 _____________ .00

5. Total Amount Due (IA 1040, line 75) ................................................................................................................................ 5 _____________ .00

Part II

Declaration of Taxpayer (Be sure to keep a copy of your return)

6.

I do not want direct deposit or direct debit.

7.

I consent that my refund be directly deposited as designated below. If I have filed a joint return, this is an

irrevocable appointment of the other spouse as an agent to receive the refund.

I authorize the Iowa Department of Revenue (IDR) and its designated financial agent to initiate an electronic funds

withdrawal (direct debit) entry to the financial institution account indicated below for payment of my individual Iowa taxes

owed on this return, and the financial institution to debit the entry to this account on ____________ (the payment/settlement

date). I also authorize the financial institution involved in the processing of the electronic payment of taxes to receive

confidential information necessary to answer inquiries and resolve issues related to the payment.

NOTE: This electronic withdrawal from your bank account will be identified with the ACH Company ID 4426004574. If

you currently have a debit block on this account, please contact your financial institution to request that they allow a

withdrawal from your bank account by this ACH Company ID.

a. Name of financial institution _____________________________________________________________________________

b. Routing Number

The first two digits must be 01 through 12 or 21 through 32.

c. Account Number

d. Type of Account:

Savings

Checking

e. Will this refund go to (or payment come from) an account outside the United States?

Yes

No

Under penalties of perjury, I declare that the information I have provided to my Electronic Return Originator (ERO) and the amounts shown in Part I agree

with the amounts shown on the corresponding lines of the electronic portion of my Iowa income tax return. To the best of my knowledge and belief my return

is true, correct, and complete. I consent that my return, including any accompanying schedules and statements, be sent to the Internal Revenue Service

(IRS) by my ERO and retrieved by the Iowa Department of Revenue (IDR). If I have filed a balance due return, I understand that if the IDR does not receive

full and timely payment of my tax liability I will remain liable for the tax liability and all applicable penalties and interest. I consent that my refund be directly

deposited as designated in Part II and declare that the information shown in Part II is correct. If I have filed a joint or combined state return and elected

direct deposit, there is an irrevocable appointment of the other spouse to receive the refund. If there is an error on my federal return, I understand my state

return will be rejected. If the processing of my return, refund, or direct debit is delayed, I authorize the IDR to disclose to my ERO and/or transmitter the

reason(s) for the delay or when the refund was sent. I also consent to the IDR sending to my ERO and/or transmitter an acknowledgment of receipt of

transmission and indication of whether or not my return is accepted, and, if rejected the reason(s) for the rejection. I understand that this declaration with

required attachments must be forwarded upon request to the IDR.

Sign

Here

Spouse Signature. If a joint return, both must sign.

Date

Your Signature

Date

Part III

Declaration of Electronic Return Originator (ERO) and Paid Preparer

I declare that I have reviewed the above taxpayer’s return and that entries on form IA 8453-IND are complete and correct to the best of my knowledge. If I

am only a collector, I am not responsible for reviewing the return and only declare that this form accurately reflects the data on the return. The taxpayer will

have signed this return before submitting to the IRS. I have provided the taxpayer with a copy of all forms and information to be filed with the IDR and have

followed all other requirements described in the Iowa Modernized eFile (MeF) Developer Guide and Information for eFile Providers. I will keep form IA 8453-

IND, with attachments, on file for three years from the due date of the return or the filing date, whichever is later, and I will make a copy available to the IDR upon

request. If I am a paid preparer, under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and

statements, and to the best of my knowledge and belief, they are true, correct, and complete. This declaration is based on all information of which I have any

knowledge.

Check if paid

Date

ERO’s PTIN

Phone Number

ERO

preparer

ERO

Signature

Check if self-

(

)

Use

employed

Firm’s name (or yours

FEIN

Only

if self-employed),

address and ZIP code

Date

Phone Number

Paid

Check if self-

Paid Preparer’s

Preparer’s PTIN

employed

Signature

Preparer

(

)

Firm’s name (or yours

FEIN

Use

if self-employed),

Only

address and ZIP code

Do Not Mail This Form.

Retain completed form with your tax records for at least three years.

41-011a (08/15/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2