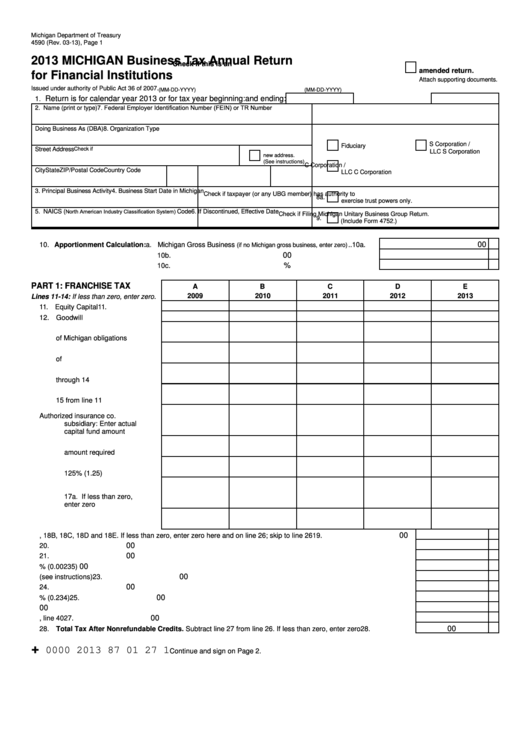

Form 4590 - Michigan Business Tax Annual Return For Financial Institutions - 2013

ADVERTISEMENT

Michigan Department of Treasury

4590 (Rev. 03-13), Page 1

2013 MICHIGAN Business Tax Annual Return

Check if this is an

amended return.

for Financial Institutions

Attach supporting documents.

Issued under authority of Public Act 36 of 2007.

(MM-DD-YYYY)

(MM-DD-YYYY)

Return is for calendar year 2013 or for tax year beginning:

and ending:

1.

7. Federal Employer Identification Number (FEIN) or TR Number

2. Name (print or type)

Doing Business As (DBA)

8. Organization Type

S Corporation /

Fiduciary

Street Address

Check if

LLC S Corporation

new address.

(See instructions)

C Corporation /

City

State

ZIP/Postal Code

Country Code

LLC C Corporation

3. Principal Business Activity

4. Business Start Date in Michigan

Check if taxpayer (or any UBG member) has authority to

8a.

exercise trust powers only.

North American Industry Classification System)

5. NAICS (

Code

6. If Discontinued, Effective Date

Check if Filing Michigan Unitary Business Group Return.

9.

(Include Form 4752.)

00

10. Apportionment Calculation:

a. Michigan Gross Business

..10a.

(if no Michigan gross business, enter zero)

00

b. Total Gross Business ...................................................................10b.

%

c. Apportionment Percentage. Divide line 10a by line 10b .............10c.

PART 1: FRANCHISE TAX

A

B

C

D

E

2009

2010

2011

2012

2013

Lines 11-14: If less than zero, enter zero.

11. Equity Capital ....................

11.

12. Goodwill .............................

12.

13. Average daily book value

of Michigan obligations ......

13.

14. Average daily book value

of U.S. obligations .............

14.

15. Subtotal. Add lines 12

through 14 .........................

15.

16. Net Capital. Subtract line

15 from line 11 ...................

16.

17. a. Authorized insurance co.

subsidiary: Enter actual

capital fund amount ....... 17a.

b. Minimum regulatory

amount required ............ 17b.

c. Multiply line 17b by

125% (1.25) ................... 17c.

d. Subtract line 17c from

17a. If less than zero,

enter zero ...................... 17d.

18. Add lines 16 and 17d .........

18.

00

19. Add lines 18A, 18B, 18C, 18D and 18E. If less than zero, enter zero here and on line 26; skip to line 26 ............

19.

00

20. Net Capital for Current Taxable Year. Divide line 19 by number of tax years reported above ................................

20.

00

21. Apportioned Tax Base. Multiply line 20 by percentage on line 10c ........................................................................

21.

00

22. Tax Before Surcharge. Multiply line 21 by 0.235% (0.00235).................................................................................

22.

00

23. Tax liability for entities with authority to exercise trust powers only (see instructions) ...........................................

23.

00

24. Tax subject to surcharge. Subtract line 23 from line 22 ..........................................................................................

24.

00

25. Surcharge. Multiply line 24 by 23.4% (0.234) .........................................................................................................

25.

00

26. Total Liability Before All Credits. Add lines 22 and 25.............................................................................................

26.

00

27. Nonrefundable credits from Form 4568, line 40 .....................................................................................................

27.

00

28. Total Tax After Nonrefundable Credits. Subtract line 27 from line 26. If less than zero, enter zero ...................

28.

+

0000 2013 87 01 27 1

Continue and sign on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7