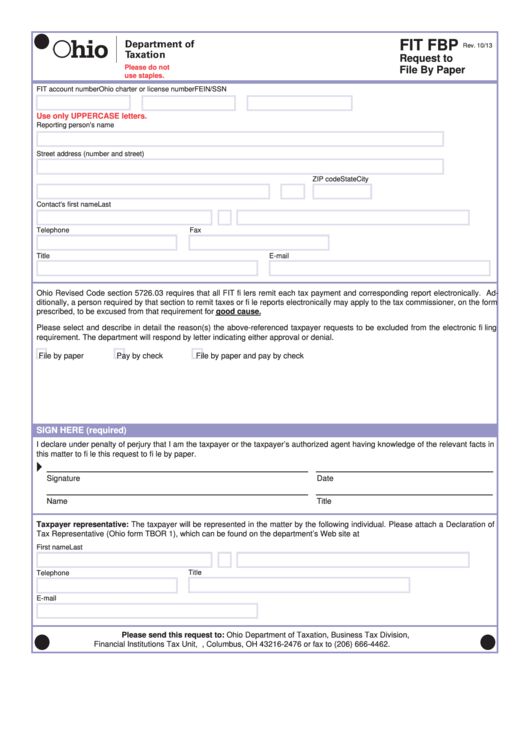

Reset Form

FIT FBP

Rev. 10/13

Request to

Please do not

File By Paper

use staples.

FIT account number

Ohio charter or license number

FEIN/SSN

Use only UPPERCASE letters.

Reporting person's name

Street address (number and street)

City

State

ZIP code

Contact's fi rst name

M.I.

Last name

Telephone

Fax

Title

E-mail

Ohio Revised Code section 5726.03 requires that all FIT fi lers remit each tax payment and corresponding report electronically. Ad-

ditionally, a person required by that section to remit taxes or fi le reports electronically may apply to the tax commissioner, on the form

prescribed, to be excused from that requirement for good cause.

Please select and describe in detail the reason(s) the above-referenced taxpayer requests to be excluded from the electronic fi ling

requirement. The department will respond by letter indicating either approval or denial.

File by paper

Pay by check

File by paper and pay by check

SIGN HERE (required)

I declare under penalty of perjury that I am the taxpayer or the taxpayer’s authorized agent having knowledge of the relevant facts in

this matter to fi le this request to fi le by paper.

Signature

Date (MM/DD/YY)

Name

Title

Taxpayer representative: The taxpayer will be represented in the matter by the following individual. Please attach a Declaration of

Tax Representative (Ohio form TBOR 1), which can be found on the department’s Web site at tax.ohio.gov.

First name

M.I.

Last name

Telephone

Title

E-mail

Please send this request to: Ohio Department of Taxation, Business Tax Division,

Financial Institutions Tax Unit, P.O. Box 2476, Columbus, OH 43216-2476 or fax to (206) 666-4462.

1

1