Page 2

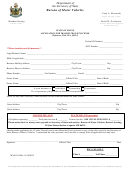

B-202A

Web

Instructions

12-12

General Information: Use this form if you are beginning in business and do not have the required State privilege license.

If you are renewing your State privilege license, it is preferable to use the renewal notice you received from the Department

of Revenue instead of this form. Use a separate form for each profession and each business location. Professional

individuals complete Part 1. Loan agencies, check cashers, or pawnbrokers complete Part 2. Fill in the applicable circle

for Parts 1 and 2 to indicate whether this application is a first time applicant or a renewal applicant. Complete the form in

blue or black ink. Do not send a photocopy of this form. The original form is printed in pink and black ink.

Individuals who engage in the practice of a profession listed in the following table and loan agencies, check cashers, and

pawnbrokers must obtain a State privilege license and pay a tax before they engage in business. For purposes of this tax,

an individual engages in the practice of a profession when the person represents to the public that the person is engaged in

the profession. The tax does not apply to an individual who is a salaried employee of a governmental unit unless either the

unit charges a fee for the services of the employed individual and the individual receives part or all of the fee, either directly

or indirectly, or the individual engages in practice outside the salaried employment.

Code

Code

Number

License Description

Tax

Number

License Description

Tax

427

Accountant

$50.00

442

Ophthalmologist

$50.00

429

Certified Public Accountant

$50.00

443

Optician

$50.00

430

Assistant Accountants (Per

444

Optometrist

$50.00

assistant issued in the name

445

Osteopath

$50.00

of the manager) _____(Number

446

Photographer

$50.00

of Assistants) X $12.50

$

447

Photographer’s Agent

$50.00

431

Architect

$50.00

448

Physician

$50.00

432

Art of Healing

$50.00

449

Podiatrist

$50.00

433

Attorney

$50.00

450

Psychologist

$50.00

434

Chiropodist

$50.00

451

Real Estate (Only one license

435

Chiropractor

$50.00

required if engaged in multiple

436

Dentist

$50.00

real estate activities)

$50.00

437

Embalmer

$50.00

452

Veterinarian

$50.00

438

Engineer

$50.00

453

Licensed Home Inspector

$50.00

439

Land Surveyor

$50.00

567

Loan Agency

$250.00

440

Landscape Architect

$50.00

568

Check Casher

$250.00

441

Naturopath

$50.00

569

Pawnbroker

$250.00

Tax Year: The State privilege license tax is an annual tax that is imposed on a fiscal year basis that begins July 1 and

ends the following June 30. Enter the appropriate year in the space provided. A first-time applicant must enter the date the

applicant will start to engage in the activity that is subject to tax. The tax must be paid before the applicant engages in the

activity. An applicant who starts to engage in an activity after July 1 of a year may not prorate the tax.

Name and Tax Identification Number: If you are a professional individual other than an assistant accountant, enter your

name and social security number. Assistant accountants should enter the name and social security number of their principal

or manager. A license issued to an individual who engages in a profession is issued as a personal privilege license and is

not issued in the name of a firm or another business entity. If you are a loan agency, check casher, or pawnbroker, enter the

legal name of the business, any trade name of the business, and the federal employer identification number of the business.

A license issued to a loan agency, check casher, or pawnbroker is issued in the business name.

Due Date: An initial annual State privilege license tax is due before the start of the activity that requires the license. An

application for an initial privilege license made after the start date of the activity is subject to penalties for failure to obtain a

license (5% per month, with 25% maximum and $5 minimum) and failure to pay a tax when due (10% of tax due, $5 minimum).

A renewal of an annual State privilege license tax is due by July 1. A late renewal application is subject to penalties for

failure to obtain a license (5% per month, with 25% maximum and $5 minimum) and failure to pay a tax when due (10% of

tax due, $5 minimum). Interest will be due on the unpaid tax. The rate is set semiannually by the Secretary of Revenue and

is available on the Department’s website,

Change of Name or Address: If your preprinted name or address on the privilege license is incorrect, please call the

Department’s Form Line at (877) 252-3052 (toll-free) to request a Form NC-AC, Business Address Correction, or you may

write to Privilege License Tax, Customer Service, PO Box 1168, Raleigh, NC 27602-1168.

Questions: If you have questions about this form, call toll free 1-877-252-3052.

1

1 2

2