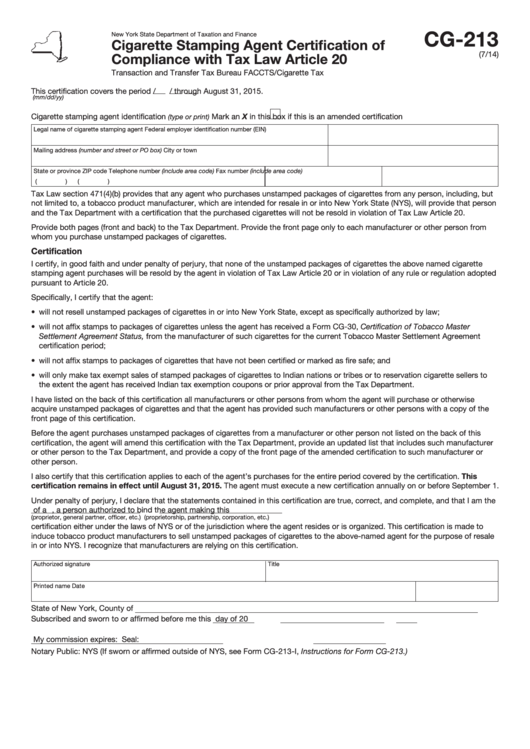

Form Cg-213 - Cigarette Stamping Agent Certification Of Compliance With Tax Law Article 20

ADVERTISEMENT

CG-213

New York State Department of Taxation and Finance

Cigarette Stamping Agent Certification of

(7/14)

Compliance with Tax Law Article 20

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

This certification covers the period

/

/

through August 31, 2015.

(mm/dd/yy)

Mark an X in this box if this is an amended certification

Cigarette stamping agent identification

(type or print)

Legal name of cigarette stamping agent

Federal employer identification number (EIN)

Mailing address (number and street or PO box)

City or town

State or province

ZIP code

Telephone number (include area code)

Fax number (include area code)

(

)

(

)

Tax Law section 471(4)(b) provides that any agent who purchases unstamped packages of cigarettes from any person, including, but

not limited to, a tobacco product manufacturer, which are intended for resale in or into New York State (NYS), will provide that person

and the Tax Department with a certification that the purchased cigarettes will not be resold in violation of Tax Law Article 20.

Provide both pages (front and back) to the Tax Department. Provide the front page only to each manufacturer or other person from

whom you purchase unstamped packages of cigarettes.

Certification

I certify, in good faith and under penalty of perjury, that none of the unstamped packages of cigarettes the above named cigarette

stamping agent purchases will be resold by the agent in violation of Tax Law Article 20 or in violation of any rule or regulation adopted

pursuant to Article 20.

Specifically, I certify that the agent:

• will not resell unstamped packages of cigarettes in or into New York State, except as specifically authorized by law;

• will not affix stamps to packages of cigarettes unless the agent has received a Form CG-30, Certification of Tobacco Master

Settlement Agreement Status, from the manufacturer of such cigarettes for the current Tobacco Master Settlement Agreement

certification period;

• will not affix stamps to packages of cigarettes that have not been certified or marked as fire safe; and

• will only make tax exempt sales of stamped packages of cigarettes to Indian nations or tribes or to reservation cigarette sellers to

the extent the agent has received Indian tax exemption coupons or prior approval from the Tax Department.

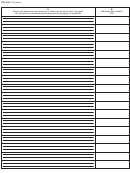

I have listed on the back of this certification all manufacturers or other persons from whom the agent will purchase or otherwise

acquire unstamped packages of cigarettes and that the agent has provided such manufacturers or other persons with a copy of the

front page of this certification.

Before the agent purchases unstamped packages of cigarettes from a manufacturer or other person not listed on the back of this

certification, the agent will amend this certification with the Tax Department, provide an updated list that includes such manufacturer

or other person to the Tax Department, and provide a copy of the front page of the amended certification to such manufacturer or

other person.

I also certify that this certification applies to each of the agent’s purchases for the entire period covered by the certification. This

certification remains in effect until August 31, 2015. The agent must execute a new certification annually on or before September 1.

Under penalty of perjury, I declare that the statements contained in this certification are true, correct, and complete, and that I am the

of a

, a person authorized to bind the agent making this

(proprietor, general partner, officer, etc.)

(proprietorship, partnership, corporation, etc.)

certification either under the laws of NYS or of the jurisdiction where the agent resides or is organized. This certification is made to

induce tobacco product manufacturers to sell unstamped packages of cigarettes to the above-named agent for the purpose of resale

in or into NYS. I recognize that manufacturers are relying on this certification.

Authorized signature

Title

Printed name

Date

State of New York, County of

Subscribed and sworn to or affirmed before me this

day of

20

My commission expires:

Seal:

Notary Public: NYS (If sworn or affirmed outside of NYS, see Form CG-213-I, Instructions for Form CG-213.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2