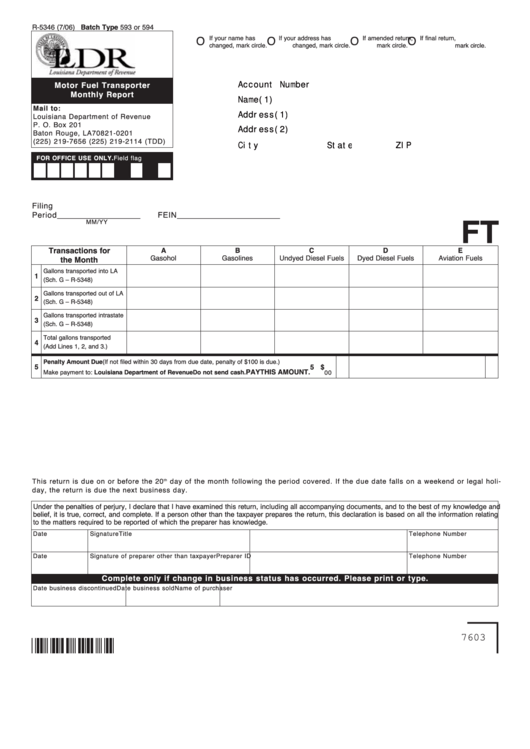

R-5346 (7/06) Batch Type 593 or 594

If your name has

If your address has

If amended return,

If final return,

O

O

O

O

changed, mark circle.

changed, mark circle.

mark circle.

mark circle.

Account Number

Motor Fuel Transporter

Monthly Report

Name(1)

Mail to:

Address(1)

Louisiana Department of Revenue

P. O. Box 201

Address(2)

Baton Rouge, LA 70821-0201

(225) 219-7656 (225) 219-2114 (TDD)

City

State

ZIP

FOR OFFICE USE ONLY.

Field flag

Filing

Period_____________________

FEIN__________________________

MM/YY

FT

Transactions for

A

B

C

D

E

Gasohol

Gasolines

Undyed Diesel Fuels

Dyed Diesel Fuels

Aviation Fuels

the Month

Gallons transported into LA

1

(Sch. G – R-5348)

Gallons transported out of LA

2

(Sch. G – R-5348)

Gallons transported intrastate

3

(Sch. G – R-5348)

Total gallons transported

4

(Add Lines 1, 2, and 3.)

Penalty Amount Due (If not filed within 30 days from due date, penalty of $100 is due.)

5

5 $

PAY THIS AMOUNT.

Make payment to: Louisiana Department of Revenue

Do not send cash.

00

This return is due on or before the 20

th

day of the month following the period covered. If the due date falls on a weekend or legal holi-

day, the return is due the next business day.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and

belief, it is true, correct, and complete. If a person other than the taxpayer prepares the return, this declaration is based on all the information relating

to the matters required to be reported of which the preparer has knowledge.

Date

Signature

Title

Telephone Number

Date

Signature of preparer other than taxpayer

Preparer ID

Telephone Number

Complete only if change in business status has occurred. Please print or type.

Date business discontinued

Date business sold

Name of purchaser

7603

1

1