Form Au-629 - Application For Refund/reimbursement Of Taxes Paid On Fuel Sold To Governmental Entities By Registered Distributors Page 4

ADVERTISEMENT

Page 4 of 4 AU-629 (4/11)

Instructions

Who may use this form

Lines 4 and 5 - Enter the number of gallons and applicable

petroleum business tax paid from Schedule A and Schedule B.

Any person who is registered with the Department as a Diesel

Motor Fuel Distributor and/or a Motor Fuel Distributor, may

Line 6 - Add the tax paid on lines 4 and 5, (Column B), and

use this form to claim a refund/reimbursement of the taxes

enter on this line.

prepaid to their supplier on fuel sold to governmental entities.

Lines 7 and 8 - Enter the number of gallons and applicable

The refund/reimbursement claimed on this form can only

prepaid sales tax paid from Schedule A and Schedule B.

be for the taxes for which you hold a valid license issued by

the Department. For example, if you are licensed as a Diesel

Line 9 - Add the tax paid on lines 7 and 8, (Column B) and enter

Motor Fuel Distributor and you are also a wholesaler/retailer

on this line.

of motor fuel and are not licensed with the Department as a

Motor Fuel Distributor, you may use this form to claim your

Line 10 - Add lines 3, 6 and 9 and enter the total on this line.

refund/reimbursement for the taxes prepaid on the diesel

motor fuel sold to governmental entities, but you must use

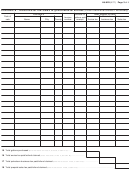

Schedules A and B

Form FT-946/1046, Motor/Diesel Motor Fuel Tax Refund

Complete all columns of Schedules A and B. Enter

Application, to claim your refund for the taxes paid on motor

information for those sales for which a refund/reimbursement

fuel sold to governmental entities.

is claimed. Include your sales of motor fuel on

Form PT-101.3, Nontaxable Sales of Motor Fuel, or PT-102.2,

When to file

Diesel Motor Fuel Nontaxable Sales, for the month of sale.

An application for refund/reimbursement may be filed on a

Attach copies of all invoices listed. Attach additional sheets if

weekly basis. For distributors filing refund/reimbursement

necessary. Be sure to total the Number of gallons sold exempt

applications for periods of less than one month, the period

and Taxes prepaid by seller columns. The totals of these

covered by the application must begin and end in the same

columns must be carried forward to page 1 as indicated.

calendar month.

Mail to:

NYS TAX DEPARTMENT

Claims for refund/reimbursement of the motor fuel or diesel

FUEL TAX REFUND UNIT

motor fuel excise tax and the petroleum business tax must be

PO BOX 5501

filed within three years from the date of purchase. Claims for

ALBANY NY 12205-0501

refund of the New York State and local sales tax must be filed

within three years from the date the tax was due.

Paid preparer

If you pay someone to prepare Form AU-629, the paid

General instructions

preparer must also sign it and fill in the other blanks in the paid

preparer’s area. If someone prepares Form AU-629 for you and

In order to expedite the processing of a refund/reimbursement

does not charge you, that person should not sign it.

claim, a claimant must furnish the necessary substantiation and

adhere to the following procedures:

Note to paid preparers — When signing Form AU-629, you

— You must complete the entire application and schedules.

must enter your New York tax preparer registration identification

Attach a worksheet, if necessary, and include adding

number (NYTPRIN) if you are required to have one. (Information

machine tapes if the worksheet is not computer generated;

on the New York State Tax Preparer Registration Program is

available on our Web site.) Also, you must enter your federal

— You must furnish proof of tax-paid purchases in the form of

preparer tax identification number (PTIN) if you have one; if

purchase invoices showing each tax (motor fuel and/or diesel

not, you must enter your social security number (SSN). (PTIN

motor fuel excise tax, petroleum business tax and prepaid

information is available at )

sales tax) listed separately;

— You must furnish proof of tax-free sales in the form of sales

Privacy notification — The Commissioner of Taxation and Finance may collect

and maintain personal information pursuant to the New York State Tax Law,

invoices issued to the governmental entity;

including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505,

697, 1096, 1142, and 1415 of that Law; and may require disclosure of social

— Include the telephone number for your business in case we

security numbers pursuant to 42 USC 405(c)(2)(C)(i).

need to contact you concerning your refund/reimbursement.

This information will be used to determine and administer tax liabilities and, when

If you prefer that we communicate with your representative

authorized by law, for certain tax offset and exchange of tax information programs

(accountant, attorney, etc.), you must include a properly

as well as for any other lawful purpose.

executed power of attorney.

Information concerning quarterly wages paid to employees is provided to certain

state agencies for purposes of fraud prevention, support enforcement, evaluation

of the effectiveness of certain employment and training programs and other

Additional documentation may be requested by the Tax

purposes authorized by law.

Department upon review of the refund/reimbursement

Failure to provide the required information may subject you to civil or criminal

application submitted. After the refund/reimbursement has been

penalties, or both, under the Tax Law.

paid, the purchase and sales invoices will be returned provided

This information is maintained by the Manager of Document Management,

NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone

a stamped self-addressed envelope with sufficient postage is

(518) 457-5181.

sent with this application.

You must keep all records and other supporting documents,

Need help?

including those related to purchases and use, used to complete

this refund/reimbursement application for a period of at least

three years and be able to produce them upon request of the

Internet access:

Tax Department.

(for information, forms, and publications)

Line instructions

Miscellaneous Tax Information Center:

(518) 457-5735

Lines 1 and 2 - Enter the number of gallons and applicable

To order forms and publications:

(518) 457-5431

excise tax paid from Schedule A and Schedule B.

Text Telephone (TTY) Hotline

Line 3 - Add the tax paid on lines 1 and 2, (Column B) and enter

(for persons with hearing and

on this line.

speech disabilities using a TTY):

(518) 485-5082

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4