Form Au-629 - Application For Refund/reimbursement Of Taxes Paid On Fuel Sold To Governmental Entities By Registered Distributors

ADVERTISEMENT

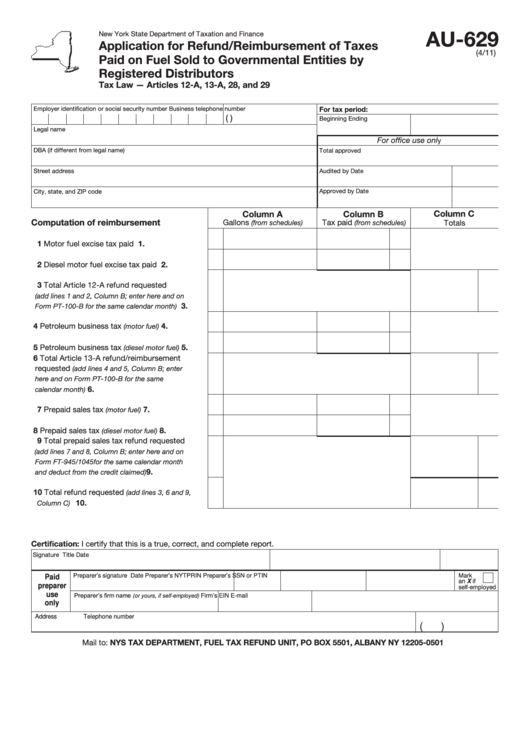

AU-629

New York State Department of Taxation and Finance

Application for Refund/Reimbursement of Taxes

(4/11)

Paid on Fuel Sold to Governmental Entities by

Registered Distributors

Tax Law — Articles 12-A, 13-A, 28, and 29

Employer identification or social security number

Business telephone number

For tax period:

(

)

Beginning

Ending

Legal name

For office use onl

y

DBA (if different from legal name)

Total approved

Street address

Audited by

Date

Approved by

Date

City, state, and ZIP code

Column A

Column B

Column C

Computation of reimbursement

Gallons

Tax paid

Totals

(from schedules)

(from schedules)

1 Motor fuel excise tax paid ...............................

1.

2 Diesel motor fuel excise tax paid ....................

2.

3 Total Article 12-A refund requested

(add lines 1 and 2, Column B; enter here and on

......

3.

Form PT-100-B for the same calendar month)

4 Petroleum business tax

..................

4.

(motor fuel)

5 Petroleum business tax

........

5.

(diesel motor fuel)

6 Total Article 13-A refund/reimbursement

requested

(add lines 4 and 5, Column B; enter

here and on Form PT-100-B for the same

.................................................

6.

calendar month)

7 Prepaid sales tax

7.

............................

(motor fuel)

8 Prepaid sales tax

..................

8.

(diesel motor fuel)

9 Total prepaid sales tax refund requested

(add lines 7 and 8, Column B; enter here and on

Form FT-945/1045 for the same calendar month

.....................

9.

and deduct from the credit claimed)

10 Total refund requested

(add lines 3, 6 and 9,

...................................................

10.

Column C)

Certification: I certify that this is a true, correct, and complete report.

Signature

Title

Date

Preparer’s signature

Date

Preparer’s NYTPRIN

Preparer’s SSN or PTIN

Mark

Paid

an X if

preparer

self-employed

use

Preparer’s firm name

(or yours, if self-employed)

Firm’s EIN

E-mail

only

Address

Telephone number

(

)

Mail to: NYS TAX DEPARTMENT, FUEL TAX REFUND UNIT, PO BOX 5501, ALBANY NY 12205-0501

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4