For the month of ________________________, 20 _____

Business name _____________________________________________ License Number _________________

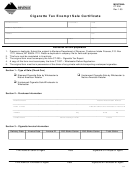

Section 2 – Cigarette Decals Reconciliation

Decal package type

Roll

Sheet

Sheet

20/pack

20/pack

25/pack

decals

decals

decals

Total

Individual decal tax type

(A)

(B)

(C)

(A + B + C = D)

8. Beginning of period inventory ....................

9. Total decals purchased during period ........

10. Total decals (Add line 9 and line 10) .........

11. Deduct number of damaged decals ...........

12. Deduct: Period ending inventory ...............

13. Total taxable decals affixed (subtract line

11, and 12 from 10) ...................................

14. Decal taxable value

$1.70

$1.70

$2.125

15. Total tax value of decals............................. $

$

$

16. Total tax value (add line 15A, 15B, and 15C)......................................................................

$

17. Total distribution into Montana

(multiply line 4 of section 1 by $0.085/cigarette) ................................................................

$

18. Difference between the 2 lines above (subtract line 17 from line 16) ................................

$

19. Deduct total value of exempted sales (multiply total schedule C by $0.085/cigarette) .......

$

20. Total Montana cigarette tax collected (subtract line 19 from line 17)..................................

$

I hereby swear and affirm under penalty of false swearing that the information herein and attachments are true

and correct to the best of my knowledge.

Print Name of Principal or Agent

Date

Signature of Principal or Agent

Page 2

305

1

1 2

2 3

3 4

4 5

5