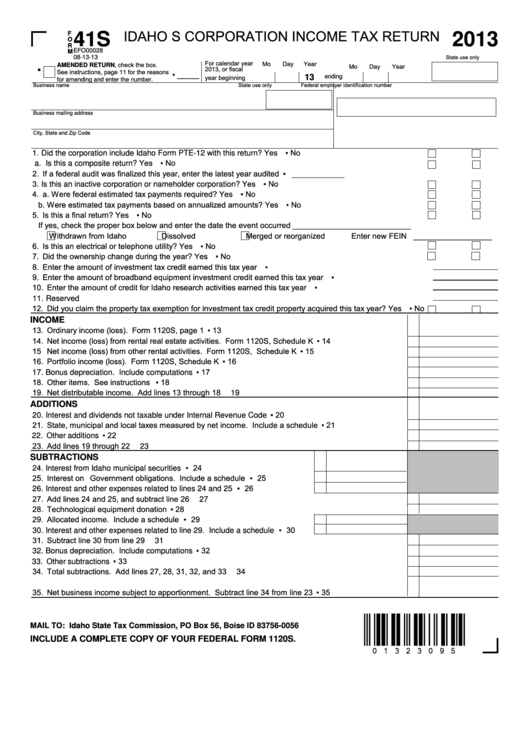

IDAHO S CORPORATION INCOME TAX RETURN

F

41s

2013

o

r

EFO00028

m

State use only

08-13-13

For calendar year

.

Mo Day Year

amended return, check the box.

Mo Day Year

2013, or fiscal

See instructions, page 11 for the reasons

▪ _____

year beginning

13

ending

for amending and enter the number.

Business name

State use only

Federal employer identification number

Business mailing address

City, State and Zip Code

Yes ▪

No

1. Did the corporation include Idaho Form PTE-12 with this return? .....................................................................

Yes ▪

No

a. Is this a composite return? ............................................................................................................................

2. If a federal audit was finalized this year, enter the latest year audited ................................. ▪ ____________

Yes ▪

No

3. Is this an inactive corporation or nameholder corporation? ...............................................................................

4. a. Were federal estimated tax payments required? ...........................................................................................

Yes ▪

No

b. Were estimated tax payments based on annualized amounts? ....................................................................

Yes ▪

No

5. Is this a final return? ...........................................................................................................................................

Yes ▪

No

If yes, check the proper box below and enter the date the event occurred ___________________________

Withdrawn from Idaho Dissolved Merged or reorganized Enter new FEIN __________________

6. Is this an electrical or telephone utility? .............................................................................................................

Yes ▪

No

7. Did the ownership change during the year? ......................................................................................................

Yes ▪

No

8. Enter the amount of investment tax credit earned this tax year ......................................................................... ▪

9. Enter the amount of broadband equipment investment credit earned this tax year ........................................... ▪

10. Enter the amount of credit for Idaho research activities earned this tax year .................................................... ▪

11. Reserved ...........................................................................................................................................................

12. Did you claim the property tax exemption for investment tax credit property acquired this tax year? ...............

Yes ▪

No

income

13. Ordinary income (loss). Form 1120S, page 1 ......................................................................................... ▪ 13

14. Net income (loss) from rental real estate activities. Form 1120S, Schedule K ....................................... ▪ 14

15 Net income (loss) from other rental activities. Form 1120S, Schedule K ............................................... ▪ 15

16. Portfolio income (loss). Form 1120S, Schedule K................................................................................... ▪ 16

17. Bonus depreciation. Include computations ............................................................................................. ▪ 17

18. Other items. See instructions ................................................................................................................. ▪ 18

19. Net distributable income. Add lines 13 through 18 ..................................................................................

19

additions

20. Interest and dividends not taxable under Internal Revenue Code ........................................................... ▪ 20

21. State, municipal and local taxes measured by net income. Include a schedule ..................................... ▪ 21

22. Other additions ......................................................................................................................................... ▪ 22

23. Add lines 19 through 22 ...........................................................................................................................

23

subtractions

24. Interest from Idaho municipal securities ....................................................... ▪ 24

25. Interest on U.S. Government obligations. Include a schedule ..................... ▪ 25

26. Interest and other expenses related to lines 24 and 25 ................................ ▪ 26

27. Add lines 24 and 25, and subtract line 26 ................................................................................................

27

28. Technological equipment donation ........................................................................................................... ▪ 28

29. Allocated income. Include a schedule .......................................................... ▪ 29

30. Interest and other expenses related to line 29. Include a schedule ............. ▪ 30

31. Subtract line 30 from line 29 ....................................................................................................................

31

32. Bonus depreciation. Include computations ............................................................................................. ▪ 32

33. Other subtractions .................................................................................................................................... ▪ 33

34. Total subtractions. Add lines 27, 28, 31, 32, and 33 ...............................................................................

34

35. Net business income subject to apportionment. Subtract line 34 from line 23 ....................................... ▪ 35

{"A?¦}

maiL to: idaho state tax commission, Po box 56, boise id 83756-0056

incLude a comPLete coPY oF Your FederaL Form 1120s.

1

1 2

2