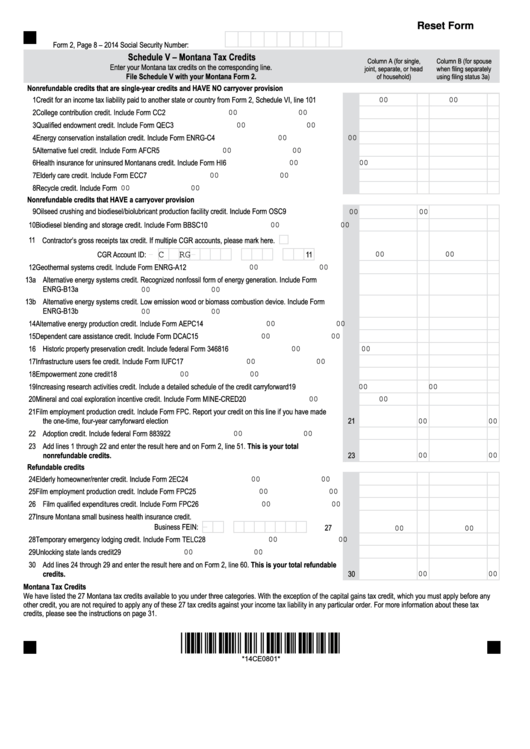

Reset Form

Form 2, Page 8 – 2014

Social Security Number:

Schedule V – Montana Tax Credits

Column A (for single,

Column B (for spouse

Enter your Montana tax credits on the corresponding line.

joint, separate, or head

when filing separately

File Schedule V with your Montana Form 2.

of household)

using filing status 3a)

Nonrefundable credits that are single-year credits and HAVE NO carryover provision

1 Credit for an income tax liability paid to another state or country from Form 2, Schedule VI, line 10 ...........

1

00

00

2 College contribution credit. Include Form CC ................................................................................................

2

00

00

3 Qualified endowment credit. Include Form QEC ...........................................................................................

3

00

00

4 Energy conservation installation credit. Include Form ENRG-C ....................................................................

4

00

00

5 Alternative fuel credit. Include Form AFCR ...................................................................................................

5

00

00

6 Health insurance for uninsured Montanans credit. Include Form HI .............................................................

6

00

00

7 Elderly care credit. Include Form ECC ..........................................................................................................

7

00

00

8 Recycle credit. Include Form RCYL...............................................................................................................

8

00

00

Nonrefundable credits that HAVE a carryover provision

9 Oilseed crushing and biodiesel/biolubricant production facility credit. Include Form OSC ............................

9

00

00

10 Biodiesel blending and storage credit. Include Form BBSC ..........................................................................

10

00

00

11 Contractor’s gross receipts tax credit. If multiple CGR accounts, please mark here.

-

-

C

G

R

00

00

CGR Account ID:

11

12 Geothermal systems credit. Include Form ENRG-A ......................................................................................

12

00

00

13a Alternative energy systems credit. Recognized nonfossil form of energy generation. Include Form

ENRG-B ......................................................................................................................................................... 13a

00

00

13b Alternative energy systems credit. Low emission wood or biomass combustion device. Include Form

ENRG-B ......................................................................................................................................................... 13b

00

00

14 Alternative energy production credit. Include Form AEPC ............................................................................

14

00

00

15 Dependent care assistance credit. Include Form DCAC ...............................................................................

15

00

00

16 Historic property preservation credit. Include federal Form 3468 ..................................................................

16

00

00

17 Infrastructure users fee credit. Include Form IUFC .......................................................................................

17

00

00

18 Empowerment zone credit .............................................................................................................................

18

00

00

19 Increasing research activities credit. Include a detailed schedule of the credit carryforward ........................

19

00

00

20 Mineral and coal exploration incentive credit. Include Form MINE-CRED ....................................................

20

00

00

21 Film employment production credit. Include Form FPC. Report your credit on this line if you have made

the one-time, four-year carryforward election ................................................................................................

21

00

00

22 Adoption credit. Include federal Form 8839 ...................................................................................................

22

00

00

23 Add lines 1 through 22 and enter the result here and on Form 2, line 51. This is your total

nonrefundable credits. ................................................................................................................................

23

00

00

Refundable credits

24 Elderly homeowner/renter credit. Include Form 2EC .....................................................................................

24

00

00

25 Film employment production credit. Include Form FPC ................................................................................

25

00

00

26 Film qualified expenditures credit. Include Form FPC ...................................................................................

26

00

00

27 Insure Montana small business health insurance credit.

-

Business FEIN:

27

00

00

28 Temporary emergency lodging credit. Include Form TELC ...........................................................................

28

00

00

29 Unlocking state lands credit ...........................................................................................................................

29

00

00

30 Add lines 24 through 29 and enter the result here and on Form 2, line 60. This is your total refundable

credits. ..........................................................................................................................................................

30

00

00

Montana Tax Credits

We have listed the 27 Montana tax credits available to you under three categories. With the exception of the capital gains tax credit, which you must apply before any

other credit, you are not required to apply any of these 27 tax credits against your income tax liability in any particular order. For more information about these tax

credits, please see the instructions on page 31.

*14CE0801*

*14CE0801*

1

1