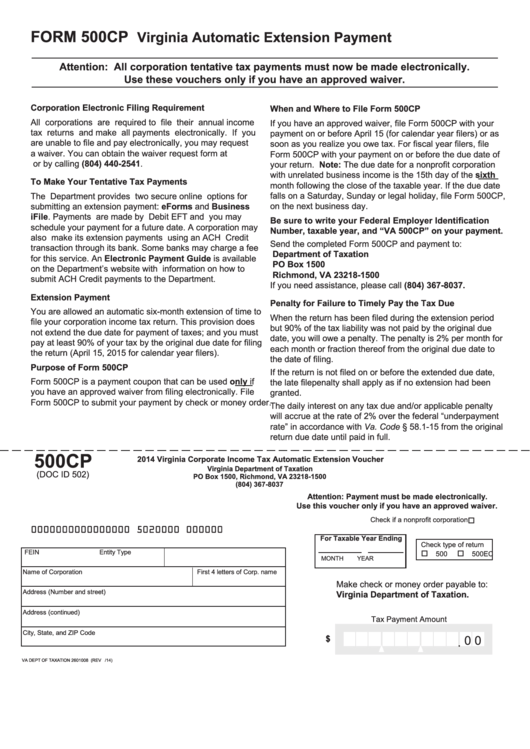

FORM 500CP

Virginia Automatic Extension Payment

Attention: All corporation tentative tax payments must now be made electronically.

Use these vouchers only if you have an approved waiver.

Corporation Electronic Filing Requirement

When and Where to File Form 500CP

All corporations are required to file their annual income

If you have an approved waiver, file Form 500CP with your

tax returns and make all payments electronically. If you

payment on or before April 15 (for calendar year filers) or as

are unable to file and pay electronically, you may request

soon as you realize you owe tax. For fiscal year filers, file

a waiver. You can obtain the waiver request form at

Form 500CP with your payment on or before the due date of

or by calling (804) 440-2541.

your return. Note: The due date for a nonprofit corporation

with unrelated business income is the 15th day of the sixth

To Make Your Tentative Tax Payments

month following the close of the taxable year. If the due date

The Department provides two secure online options for

falls on a Saturday, Sunday or legal holiday, file Form 500CP,

submitting an extension payment: eForms and Business

on the next business day.

iFile. Payments are made by Debit EFT and you may

Be sure to write your Federal Employer Identification

schedule your payment for a future date. A corporation may

Number, taxable year, and “VA 500CP” on your payment.

also make its extension payments using an ACH Credit

Send the completed Form 500CP and payment to:

transaction through its bank. Some banks may charge a fee

Department of Taxation

for this service. An Electronic Payment Guide is available

PO Box 1500

on the Department’s website with information on how to

Richmond, VA 23218-1500

submit ACH Credit payments to the Department.

If you need assistance, please call (804) 367-8037.

Extension Payment

Penalty for Failure to Timely Pay the Tax Due

You are allowed an automatic six-month extension of time to

When the return has been filed during the extension period

file your corporation income tax return. This provision does

but 90% of the tax liability was not paid by the original due

not extend the due date for payment of taxes; and you must

date, you will owe a penalty. The penalty is 2% per month for

pay at least 90% of your tax by the original due date for filing

each month or fraction thereof from the original due date to

the return (April 15, 2015 for calendar year filers).

the date of filing.

Purpose of Form 500CP

If the return is not filed on or before the extended due date,

Form 500CP is a payment coupon that can be used only if

the late file penalty shall apply as if no extension had been

you have an approved waiver from filing electronically. File

granted.

Form 500CP to submit your payment by check or money order.

The daily interest on any tax due and/or applicable penalty

will accrue at the rate of 2% over the federal “underpayment

rate” in accordance with Va. Code § 58.1-15 from the original

return due date until paid in full.

500CP

2014 Virginia Corporate Income Tax Automatic Extension Voucher

Virginia Department of Taxation

(DOC ID 502)

PO Box 1500, Richmond, VA 23218-1500

(804) 367-8037

Attention: Payment must be made electronically.

Use this voucher only if you have an approved waiver.

Check if a nonprofit corporation

0000000000000000 5020000 000000

For Taxable Year Ending

Check type of return

FEIN

Entity Type

500

500EC

MONTH

YEAR

Name of Corporation

First 4 letters of Corp. name

Make check or money order payable to:

Address (Number and street)

Virginia Department of Taxation.

Address (continued)

Tax Payment Amount

City, State, and ZIP Code

$

0 0

.

VA DEPT OF TAXATION 2601008 (REV

/14)

1

1