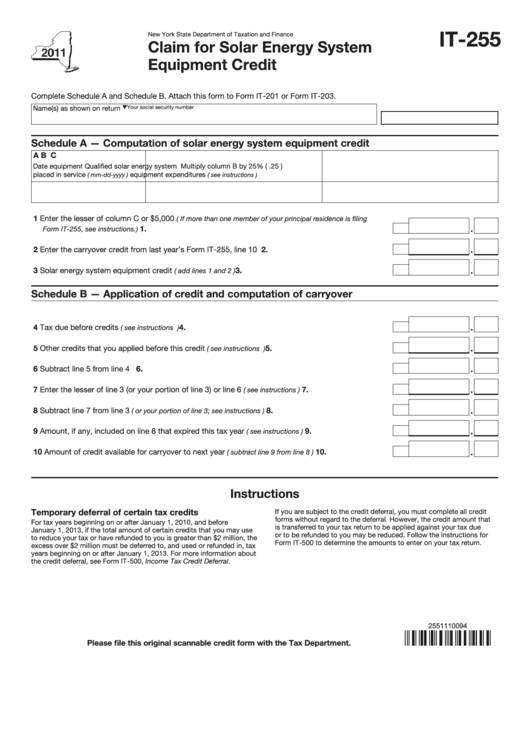

IT-255

New York State Department of Taxation and Finance

Claim for Solar Energy System

Equipment Credit

Complete Schedule A and Schedule B. Attach this form to Form IT-201 or Form IT-203.

Name(s) as shown on return

Your social security number

Schedule A — Computation of solar energy system equipment credit

A

B

C

Date equipment

Qualified solar energy system

Multiply column B by 25% ( .25 )

placed in service

equipment expenditures

( mm-dd-yyyy )

( see instructions )

1 Enter the lesser of column C or $5,000

( If more than one member of your principal residence is filing

..............................................................................................................

1.

Form IT-255, see instructions.)

2 Enter the carryover credit from last year’s Form IT-255, line 10 ..........................................................

2.

3 Solar energy system equipment credit

3.

.....................................................................

( add lines 1 and 2 )

Schedule B — Application of credit and computation of carryover

4 Tax due before credits

4.

...............................................................................................

( see instructions )

5 Other credits that you applied before this credit

......................................................

5.

( see instructions )

6 Subtract line 5 from line 4 ...................................................................................................................

6.

7 Enter the lesser of line 3 (or your portion of line 3) or line 6

7.

......................................

( see instructions )

8 Subtract line 7 from line 3

.......................................................

8.

( or your portion of line 3; see instructions )

9 Amount, if any, included on line 8 that expired this tax year

9.

.....................................

( see instructions )

10 Amount of credit available for carryover to next year

.................................. 10.

( subtract line 9 from line 8 )

Instructions

Temporary deferral of certain tax credits

If you are subject to the credit deferral, you must complete all credit

forms without regard to the deferral. However, the credit amount that

For tax years beginning on or after January 1, 2010, and before

is transferred to your tax return to be applied against your tax due

January 1, 2013, if the total amount of certain credits that you may use

or to be refunded to you may be reduced. Follow the instructions for

to reduce your tax or have refunded to you is greater than $2 million, the

Form IT-500 to determine the amounts to enter on your tax return.

excess over $2 million must be deferred to, and used or refunded in, tax

years beginning on or after January 1, 2013. For more information about

the credit deferral, see Form IT-500, Income Tax Credit Deferral.

2551110094

Please file this original scannable credit form with the Tax Department.

1

1 2

2