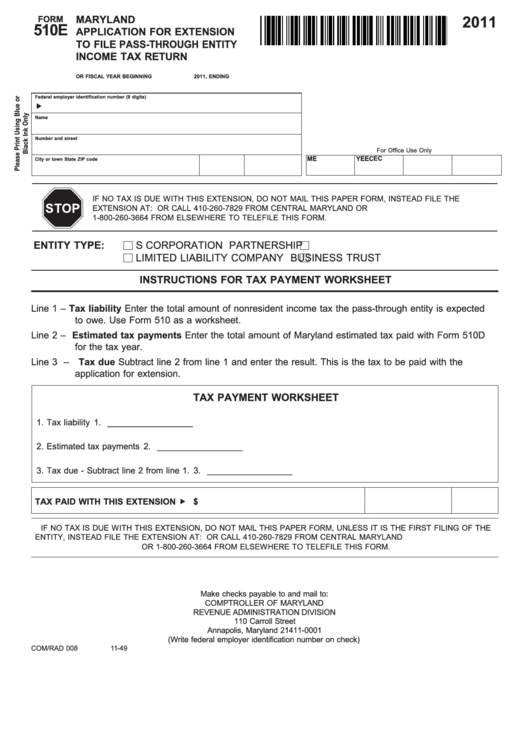

2011

MARYLAND

FORM

510E

APPLICATION FOR EXTENSION

TO FILE PASS-THROUGH ENTITY

11510E049

INCOME TAX RETURN

OR FISCAL YEAR BEGINNING

2011, ENDING

Federal employer identification number (9 digits)

Name

Number and street

For Office Use Only

EC

ME

YE

EC

City or town

State

ZIP code

IF NO TAX IS DUE WITH THIS EXTENSION, DO NOT MAIL THIS PAPER FORM, INSTEAD FILE THE

EXTENSION AT: OR CALL 410-260-7829 FROM CENTRAL MARYLAND OR

1-800-260-3664 FROM ELSEWHERE TO TELEFILE THIS FORM.

ENTITY TYPE:

S CORPORATION

PARTNERSHIP

LIMITED LIABILITY COMPANY

BUSINESS TRUST

INSTRUCTIONS FOR TAX PAYMENT WORKSHEET

Line 1 – Tax liability Enter the total amount of nonresident income tax the pass-through entity is expected

to owe. Use Form 510 as a worksheet.

Line 2 – Estimated tax payments Enter the total amount of Maryland estimated tax paid with Form 510D

for the tax year.

Line 3 – Tax due Subtract line 2 from line 1 and enter the result. This is the tax to be paid with the

application for extension.

TAX PAYMENT WORKSHEET

1. Tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. __________________

2. Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. __________________

3. Tax due - Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. __________________

TAX PAID WITH THIS EXTENSION

$

IF NO TAX IS DUE WITH THIS EXTENSION, DO NOT MAIL THIS PAPER FORM, UNLESS IT IS THE FIRST FILING OF THE

ENTITY, INSTEAD FILE THE EXTENSION AT: OR CALL 410-260-7829 FROM CENTRAL MARYLAND

OR 1-800-260-3664 FROM ELSEWHERE TO TELEFILE THIS FORM.

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION

110 Carroll Street

Annapolis, Maryland 21411-0001

(Write federal employer identification number on check)

COM/RAD 008

11-49

1

1 2

2