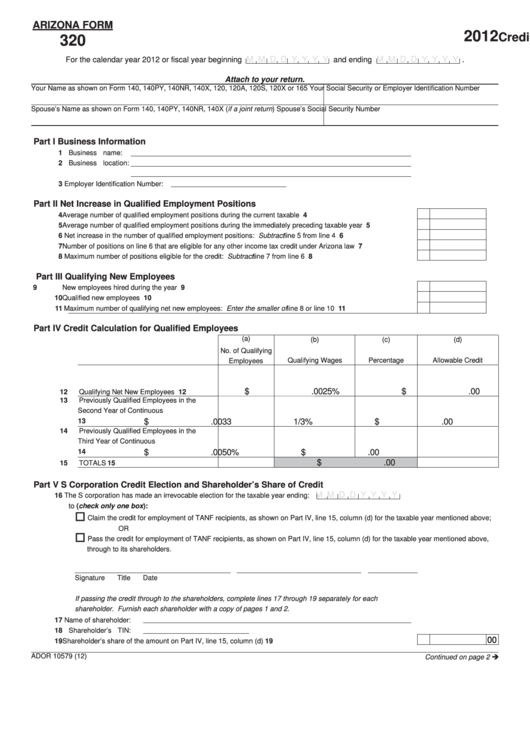

ARIZONA FORM

2012

Credit for Employment of TANF Recipients

320

M M D D Y Y Y Y

M M D D Y Y Y Y

For the calendar year 2012 or fiscal year beginning

and ending

.

Attach to your return.

Your Name as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Your Social Security or Employer Identification Number

Spouse’s Name as shown on Form 140, 140PY, 140NR, 140X (if a joint return)

Spouse’s Social Security Number

Part I Business Information

1 Business name:

2 Business location:

3 Employer Identification Number:

Part II Net Increase in Qualified Employment Positions

4 Average number of qualified employment positions during the current taxable year................................................

4

5 Average number of qualified employment positions during the immediately preceding taxable year .......................

5

6 Net increase in the number of qualified employment positions: Subtract line 5 from line 4 .....................................

6

7 Number of positions on line 6 that are eligible for any other income tax credit under Arizona law ...........................

7

8 Maximum number of positions eligible for the credit: Subtract line 7 from line 6 .....................................................

8

Part III Qualifying New Employees

9 New employees hired during the year ......................................................................................................................

9

10 Qualified new employees ..........................................................................................................................................

10

11 Maximum number of qualifying net new employees: Enter the smaller of line 8 or line 10 .....................................

11

Part IV Credit Calculation for Qualified Employees

(a)

(b)

(c)

(d)

No. of Qualifying

Qualifying Wages

Percentage

Allowable Credit

Employees

$

.00

25%

$

.00

12

Qualifying Net New Employees .............

12

13

Previously Qualified Employees in the

Second Year of Continuous

Employment...........................................

13

$

.00

33 1/3%

$

.00

14

Previously Qualified Employees in the

Third Year of Continuous

Employment...........................................

14

$

.00

50%

$

.00

$

.00

15

TOTALS .................................................

15

Part V S Corporation Credit Election and Shareholder’s Share of Credit

M M D D Y Y Y Y

16 The S corporation has made an irrevocable election for the taxable year ending:

to (check only one box):

Claim the credit for employment of TANF recipients, as shown on Part IV, line 15, column (d) for the taxable year mentioned above;

OR

Pass the credit for employment of TANF recipients, as shown on Part IV, line 15, column (d) for the taxable year mentioned above,

through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 17 through 19 separately for each

shareholder. Furnish each shareholder with a copy of pages 1 and 2.

17 Name of shareholder:

18 Shareholder’s TIN:

00

19 Shareholder’s share of the amount on Part IV, line 15, column (d)...........................................................................

19

ADOR 10579 (12)

Continued on page 2

1

1 2

2 3

3 4

4