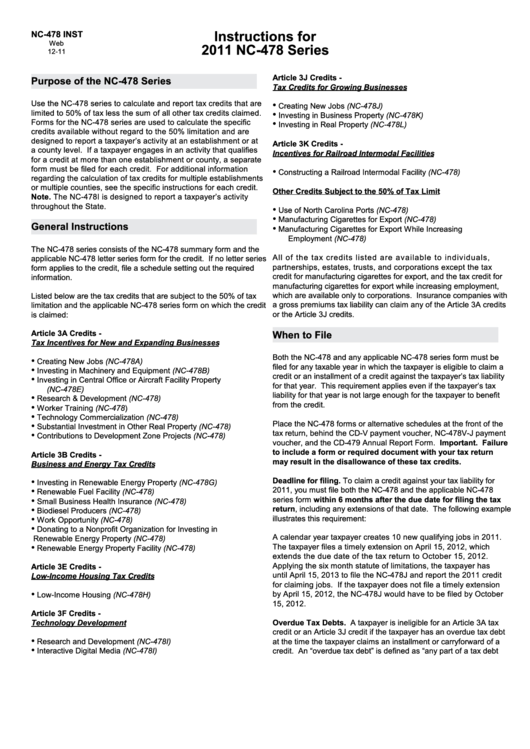

Instructions For 2011 Nc-478 Series

ADVERTISEMENT

Instructions for

NC-478 INST

Web

2011 NC-478 Series

12-11

Article 3J Credits -

Purpose of the NC-478 Series

Tax Credits for Growing Businesses

Use the NC-478 series to calculate and report tax credits that are

•

Creating New Jobs (NC-478J)

limited to 50% of tax less the sum of all other tax credits claimed.

•

Investing in Business Property (NC-478K)

Forms for the NC-478 series are used to calculate the specific

•

Investing in Real Property (NC-478L)

credits available without regard to the 50% limitation and are

designed to report a taxpayer’s activity at an establishment or at

Article 3K Credits -

a county level. If a taxpayer engages in an activity that qualifies

Incentives for Railroad Intermodal Facilities

for a credit at more than one establishment or county, a separate

form must be filed for each credit. For additional information

•

Constructing a Railroad Intermodal Facility (NC-478)

regarding the calculation of tax credits for multiple establishments

or multiple counties, see the specific instructions for each credit.

Other Credits Subject to the 50% of Tax Limit

Note. The NC-478I is designed to report a taxpayer’s activity

throughout the State.

•

Use of North Carolina Ports (NC-478)

•

Manufacturing Cigarettes for Export (NC-478)

General Instructions

•

Manufacturing Cigarettes for Export While Increasing

Employment (NC-478)

The NC-478 series consists of the NC-478 summary form and the

All of the tax credits listed are available to individuals,

applicable NC-478 letter series form for the credit. If no letter series

partnerships, estates, trusts, and corporations except the tax

form applies to the credit, file a schedule setting out the required

credit for manufacturing cigarettes for export, and the tax credit for

information.

manufacturing cigarettes for export while increasing employment,

which are available only to corporations. Insurance companies with

Listed below are the tax credits that are subject to the 50% of tax

a gross premiums tax liability can claim any of the Article 3A credits

limitation and the applicable NC-478 series form on which the credit

or the Article 3J credits.

is claimed:

Article 3A Credits -

When to File

Tax Incentives for New and Expanding Businesses

Both the NC-478 and any applicable NC-478 series form must be

•

Creating New Jobs (NC-478A)

filed for any taxable year in which the taxpayer is eligible to claim a

•

Investing in Machinery and Equipment (NC-478B)

credit or an installment of a credit against the taxpayer’s tax liability

•

Investing in Central Office or Aircraft Facility Property

for that year. This requirement applies even if the taxpayer’s tax

(NC-478E)

liability for that year is not large enough for the taxpayer to benefit

•

Research & Development (NC-478)

from the credit.

•

Worker Training (NC-478)

•

Technology Commercialization (NC-478)

•

Place the NC-478 forms or alternative schedules at the front of the

Substantial Investment in Other Real Property (NC-478)

tax return, behind the CD-V payment voucher, NC-478V-J payment

•

Contributions to Development Zone Projects (NC-478)

voucher, and the CD-479 Annual Report Form. Important. Failure

to include a form or required document with your tax return

Article 3B Credits -

may result in the disallowance of these tax credits.

Business and Energy Tax Credits

•

Deadline for filing. To claim a credit against your tax liability for

Investing in Renewable Energy Property (NC-478G)

•

2011, you must file both the NC-478 and the applicable NC-478

Renewable Fuel Facility (NC-478)

•

series form within 6 months after the due date for filing the tax

Small Business Health Insurance (NC-478)

•

return, including any extensions of that date. The following example

Biodiesel Producers (NC-478)

•

illustrates this requirement:

Work Opportunity (NC-478)

•

Donating to a Nonprofit Organization for Investing in

A calendar year taxpayer creates 10 new qualifying jobs in 2011.

Renewable Energy Property (NC-478)

•

The taxpayer files a timely extension on April 15, 2012, which

Renewable Energy Property Facility (NC-478)

extends the due date of the tax return to October 15, 2012.

Applying the six month statute of limitations, the taxpayer has

Article 3E Credits -

until April 15, 2013 to file the NC-478J and report the 2011 credit

Low-Income Housing Tax Credits

for claiming jobs. If the taxpayer does not file a timely extension

•

by April 15, 2012, the NC-478J would have to be filed by October

Low-Income Housing (NC-478H)

15, 2012.

Article 3F Credits -

Overdue Tax Debts. A taxpayer is ineligible for an Article 3A tax

Technology Development

credit or an Article 3J credit if the taxpayer has an overdue tax debt

•

Research and Development (NC-478I)

at the time the taxpayer claims an installment or carryforward of a

•

Interactive Digital Media (NC-478I)

credit. An “overdue tax debt” is defined as “any part of a tax debt

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2