Form N-756 - Enterprise Zone Tax Credit Page 2

ADVERTISEMENT

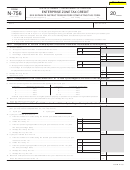

Part IV - Computation of Credit Limitation

PAGE 2

15. Are you claiming the ethanol facility tax credit (Form N-324) for this taxable year?

£

a.

No, go to line 16.

£

b.

Yes, you may not claim any other Hawaii income tax credit for this taxable year. Enter -0- on line 20.

16. Enter your total tax liability (from Part I, line 1) here. ..................................................................................................................

16

17. Are you claiming the credit for income taxes paid to another state or foreign country?

£

a.

No, enter -0- on this line and go to line 18

£

b.

Yes, enter the amount of the credit for income taxes paid to another state or foreign country you are claiming on this line...

17

18. Subtract line 17 from line 16. Enter the difference here. If line 17 is larger than line 16, enter -0- here and on line 20. ..........

18

19. Enter the amount from Part II, line 10 or Part III, 14. ..................................................................................................................

19

20. Enter the smaller of line 18 or line 19. This is the amount of your enterprise zone tax credit.

Enter this amount on Schedule CR, line 3. .................................................................................................................................

20

firms, a qualified business engages in a service

“ Service business” means any corporation, part-

GENERAL INSTRUCTIONS

business, or value is added to materials or products

nership, or sole proprietorship that repairs ships, air-

A qualified business which has received certifica-

that are manufactured by a qualified business.

craft, or assistive technology equipment, provides

tion from the Department of Business, Economic

telecommunication services, information technol-

For an individual operating as a sole proprietor-

Development & Tourism may claim the enterprise

ogy design and production services, medical and

ship, enter the amount of the business’ net income

zone tax credit.

health care services, or education and training ser-

which is attributable to the conduct of trade or busi-

A business that has been certified is entitled, sub-

vices as defined in Chapter 209E, HRS.

ness within the zone. This is calculated by multiply-

ject to the apportionment provisions, to an enter-

ing the business’ net income by a fraction; the nu-

Tangible personal property shall be sold at whole-

prise zone tax credit against any taxes due the State

merator being the total gross receipts of the trade or

sale at an establishment of a qualified business lo-

according to the following formula:

business within the zone and the denominator being

cated within an enterprise zone. The transfer of title

the total gross receipts of the business within Ha-

First year

80% of tax due

to the buyer of the tangible personal property shall

waii.

Second year

70% of tax due

take place in the same enterprise zone in which the

tangible personal property is sold.

Members should enter the amount from Form

Third year

60% of tax due

N-756A, line 2e.

Services shall be sold at an establishment of a

Fourth year

50% of tax due

qualified business engaged in a service business

Line 2b. — Enter the total gross income of the quali-

Fifth year

40% of tax due

within an enterprise zone and the services shall be

fied business within Hawaii during the taxable year,

Sixth year

30% of tax due

delivered in the same enterprise zone in which the

including sales within and outside the enterprise

Seventh year

20% of tax due

services are sold. Where the service business, in

zone. A business is taxable outside the enterprise

In addition, a business that has been certified is

the same transaction, engages in both the sale of

zone if the business has: 1) income from business

entitled, subject to the apportionment provisions, to

tangible property and services, the service business

activity within the zone which does not fall within the

an enterprise zone tax credit against any taxes due

shall segregate the sale of services from the sale of

definition of trade or business, or 2) income from

the State in an amount equal to a percentage of un-

tangible personal property.

business activity conducted outside the zone. This

employment insurance premiums paid on the pay-

term includes work that a business located within a

Value must be added to materials or products that

roll of all the business’ employees employed in the

zone subcontracts to a business located outside the

are manufactured within the enterprise zone.

enterprise zone, according to the following formula:

zone and the work is delivered outside the zone.

Each partner, S corporation shareholder, or LLC

First year

80% of premiums paid

For an individual, enter the total gross income re-

member (member) of a business that has been certi-

Second year

70% of premiums paid

quired to be reported to Hawaii, including your busi-

fied shall separately determine for the member’s

Third year

60% of premiums paid

ness’s net income (if operating as a sole proprietor-

taxable year within which the business’ taxable year

Fourth year

50% of premiums paid

ship), salary, interest income, dividend income, etc.

ends, the member’s share of the credit. The mem-

Fifth year

40% of premiums paid

ber’s share of the entity’s net income or loss and un-

Members should include in the total amount re-

Sixth year

30% of premiums paid

employment insurance credit shall be determined in

ported on line 2b, the amount from Form N-756A,

Seventh year

20% of premiums paid

accordance with the ratio in which the members di-

line 2a.

vide the profits and losses of the partnership, S cor-

If the enterprise zone tax credit exceeds the

Line 4. — Enter the total amount of unemployment

poration, or LLC respectively.

taxpayer’s tax liability, the excess of credit over

insurance premiums paid on the payroll of all the

liability shall not be refunded to the taxpayer, nor

business’ employees employed in Hawaii.

Note: ALL of the following must be attached

shall it be carried over or carried back to another

Members claiming their share of the entity’s un-

to your tax return in order to claim the enter-

tax period.

employment insurance premiums paid within the

prise zone tax credit:

The enterprise zone tax credit shall apply only to

zone should skip lines 4, and 5a-5c; and enter the

1. Form N-756, Enterprise Zone Tax Credit

the extent that a qualified business conducts trade

amount from Form N-756A, line 3e, on line 6. On the

2. Form N-756A, Information Statement, if you are

or business within the zone. A business which has

dotted line next to line 6, write “From Form N-756A.”

a partner of a partnership or a shareholder of

income taxable both within and outside Hawaii shall

Line 5a. — Enter the total payroll for employees em-

an S corporation

apportion and allocate the business’ net income un-

ployed within the zone during the taxable year. An

3. A copy of the certification issued by the Depart-

der sections 235-21 to 235-39, Hawaii Revised Stat-

employee is employed within the zone if: 1) the indi-

ment of Business, Economic Development &

utes, (HRS), prior to calculating the enterprise zone

vidual’s service is performed entirely within the

Tourism

tax credit.

zone, or 2) the individual’s service is performed both

“Trade or business” means all business activity by

SPECIFIC INSTRUCTIONS

within and without the zone, but the service per-

a qualified business within an enterprise zone,

formed without the zone is incidental to the individ-

PART I

whereby 1) tangible personal property is sold at

ual’s service within the zone.

Line 1. — Enter the total tax liability from Form N-11,

wholesale and the sale takes place within the zone,

Line 5b. — Enter the total payroll for all employees

line 27; Form N-12, line 42; Form N-15, line 44; Form

2) a qualified business engages in a service busi-

within Hawaii.

N-30, Schedule J, line 21; or Form N-70NP, line 14;

ness within the zone, or 3) value is added to materi-

whichever is applicable. (Note: For Forms N-11,

als or products that are manufactured within the

Part II

should be completed if your 7-year cycle be-

N-12, and N-15, do not include the separate tax from

zone. “Trade or business” also includes engaging in

gan at the start of your taxable year.

Forms N-2, N-103, N-152, N-312, N-318, N-405,

producing agricultural products where the business

Part III

should be completed if your 7-year cycle

is a producer as defined in section 237-5; engaging

N-586, or N-814 in your total tax liability.)

began during your taxable year rather than at the

in research, development, sale or production of all

Line 2a. — Enter the total gross income of the quali-

start of your taxable year.

types of genetically-engineered medical, agricul-

fied business from trade or business within the zone

Part IV

tural, or maritime biotechnology products; and en-

must be completed by all taxpayers claim-

during the taxable year. Gross income from trade or

gaging in producing electric power from wind energy

ing this credit.

business within the zone is received when tangible

for sale primarily to a public utility company for re-

personal property is sold at wholesale to business

sale to the public.

FORM N-756

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2