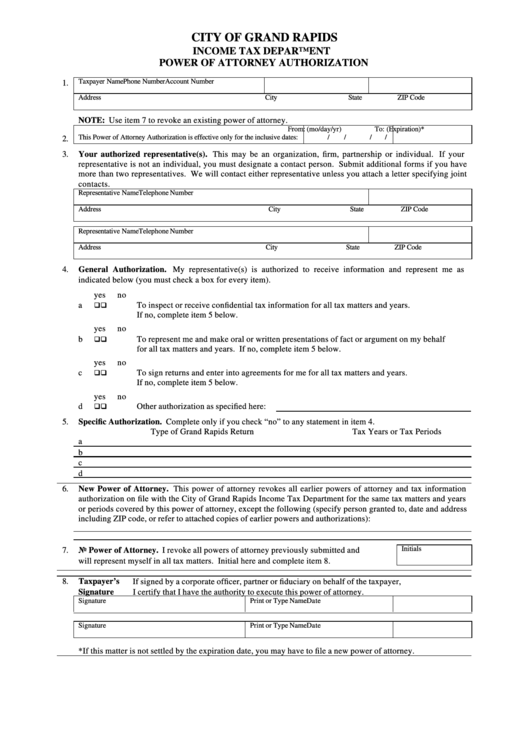

CITY OF GRAND RAPIDS

INCOME TAX DEPARTMENT

POWER OF ATTORNEY AUTHORIZATION

Taxpayer Name

Phone Number

Account Number

1.

Address

City

State

ZIP Code

NOTE: Use item 7 to revoke an existing power of attorney.

From: (mo/day/yr)

To: (Expiration)*

This Power of Attorney Authorization is effective only for the inclusive dates:

/

/

/

/

2.

3.

Your authorized representative(s). This may be an organization, firm, partnership or individual. If your

representative is not an individual, you must designate a contact person. Submit additional forms if you have

more than two representatives. We will contact either representative unless you attach a letter specifying joint

contacts.

Representative Name

Telephone Number

Address

City

State

ZIP Code

Representative Name

Telephone Number

Address

City

State

ZIP Code

4.

General Authorization. My representative(s) is authorized to receive information and represent me as

indicated below (you must check a box for every item).

yes

no

q

q

a

To inspect or receive confidential tax information for all tax matters and years.

If no, complete item 5 below.

yes

no

q

q

b

To represent me and make oral or written presentations of fact or argument on my behalf

for all tax matters and years. If no, complete item 5 below.

yes

no

q

q

c

To sign returns and enter into agreements for me for all tax matters and years.

If no, complete item 5 below.

yes

no

q

q

d

Other authorization as specified here:

5.

Specific Authorization. Complete only if you check “no” to any statement in item 4.

Type of Grand Rapids Return

Tax Years or Tax Periods

a

b

c

d

6.

New Power of Attorney. This power of attorney revokes all earlier powers of attorney and tax information

authorization on file with the City of Grand Rapids Income Tax Department for the same tax matters and years

or periods covered by this power of attorney, except the following (specify person granted to, date and address

including ZIP code, or refer to attached copies of earlier powers and authorizations):

Initials

7.

No Power of Attorney. I revoke all powers of attorney previously submitted and

will represent myself in all tax matters. Initial here and complete item 8.

8.

Taxpayer’s

If signed by a corporate officer, partner or fiduciary on behalf of the taxpayer,

Signature

I certify that I have the authority to execute this power of attorney.

Signature

Print or Type Name

Date

Signature

Print or Type Name

Date

*If this matter is not settled by the expiration date, you may have to file a new power of attorney.

1

1