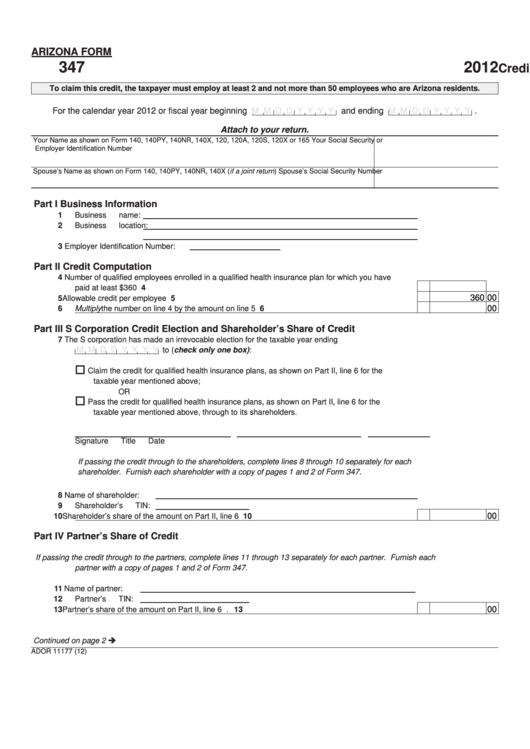

ARIZONA FORM

347

2012

Credit for Qualified Health Insurance Plans

To claim this credit, the taxpayer must employ at least 2 and not more than 50 employees who are Arizona residents.

For the calendar year 2012 or fiscal year beginning

and ending

.

M M D D Y Y Y Y

M M D D Y Y Y Y

Attach to your return.

Your Name as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Your Social Security or

Employer Identification Number

Spouse’s Name as shown on Form 140, 140PY, 140NR, 140X (if a joint return)

Spouse’s Social Security Number

Part I

Business Information

1

Business name:

2

Business location:

3

Employer Identification Number:

Part II

Credit Computation

4

Number of qualified employees enrolled in a qualified health insurance plan for which you have

paid at least $360 ...........................................................................................................................

4

360 00

5

Allowable credit per employee .......................................................................................................

5

00

6

Multiply the number on line 4 by the amount on line 5 ...................................................................

6

Part III

S Corporation Credit Election and Shareholder’s Share of Credit

7

The S corporation has made an irrevocable election for the taxable year ending

M M D D Y Y Y Y

to (check only one box):

Claim the credit for qualified health insurance plans, as shown on Part II, line 6 for the

taxable year mentioned above;

OR

Pass the credit for qualified health insurance plans, as shown on Part II, line 6 for the

taxable year mentioned above, through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 8 through 10 separately for each

shareholder. Furnish each shareholder with a copy of pages 1 and 2 of Form 347.

8

Name of shareholder:

9

Shareholder’s TIN:

10

Shareholder’s share of the amount on Part II, line 6 ......................................................................

10

00

Part IV

Partner’s Share of Credit

If passing the credit through to the partners, complete lines 11 through 13 separately for each partner. Furnish each

partner with a copy of pages 1 and 2 of Form 347.

11

Name of partner:

12

Partner’s TIN:

13

Partner’s share of the amount on Part II, line 6 ..............................................................................

13

00

Continued on page 2

ADOR 11177 (12)

1

1 2

2 3

3