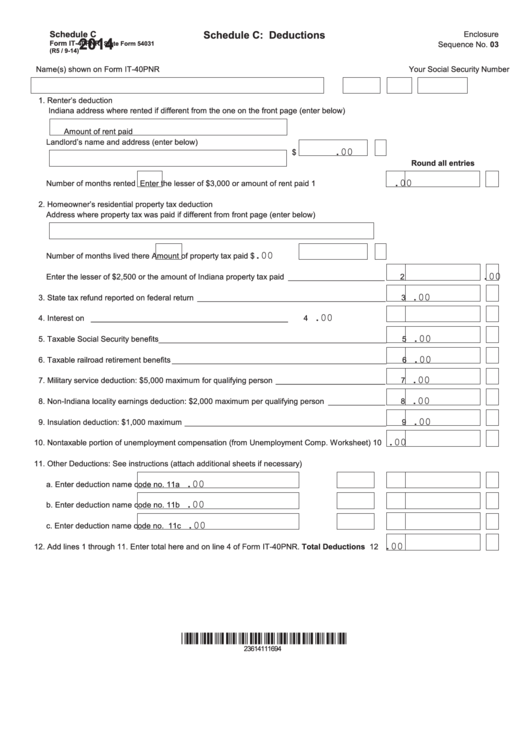

Schedule C: Deductions

Schedule C

Enclosure

2014

Form IT-40PNR,

State Form 54031

Sequence No. 03

(R5 / 9-14)

Name(s) shown on Form IT-40PNR

Your Social Security Number

1. Renter’s deduction

Indiana address where rented if different from the one on the front page (enter below)

Amount of rent paid

Landlord’s name and address (enter below)

.00

$

Round all entries

.00

Number of months rented

Enter the lesser of $3,000 or amount of rent paid

1

2. Homeowner’s residential property tax deduction

Address where property tax was paid if different from front page (enter below)

. 00

Number of months lived there

Amount of property tax paid $

.00

Enter the lesser of $2,500 or the amount of Indiana property tax paid ______________________

2

.00

3. State tax refund reported on federal return ___________________________________________

3

.00

4. Interest on U.S. government obligations _____________________________________________

4

.00

5. Taxable Social Security benefits ____________________________________________________

5

.00

6. Taxable railroad retirement benefits _________________________________________________

6

.00

7. Military service deduction: $5,000 maximum for qualifying person _________________________

7

.00

8. Non-Indiana locality earnings deduction: $2,000 maximum per qualifying person _____________

8

.00

9. Insulation deduction: $1,000 maximum ______________________________________________

9

.00

10. Nontaxable portion of unemployment compensation (from Unemployment Comp. Worksheet)

10

11. Other Deductions: See instructions (attach additional sheets if necessary)

.00

a. Enter deduction name

code no.

11a

.00

b. Enter deduction name

code no.

11b

.00

c. Enter deduction name

code no.

11c

.00

12. Add lines 1 through 11. Enter total here and on line 4 of Form IT-40PNR.

Total Deductions

12

*23614111694*

23614111694

1

1