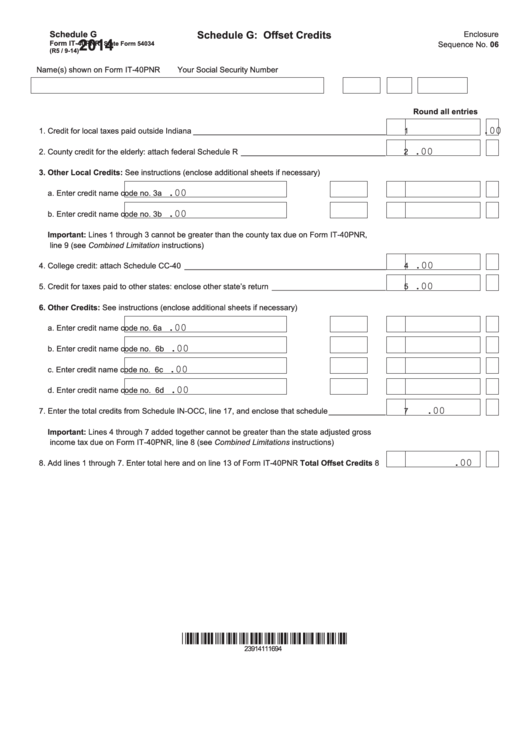

Schedule G: Offset Credits

Schedule G

Enclosure

2014

Form IT-40PNR,

State Form 54034

Sequence No. 06

(R5 / 9-14)

Name(s) shown on Form IT-40PNR

Your Social Security Number

Round all entries

.00

1. Credit for local taxes paid outside Indiana ____________________________________________

1

.00

2. County credit for the elderly: attach federal Schedule R _________________________________

2

3. Other Local Credits: See instructions (enclose additional sheets if necessary)

.00

a. Enter credit name

code no.

3a

.00

b. Enter credit name

code no.

3b

Important: Lines 1 through 3 cannot be greater than the county tax due on Form IT-40PNR,

line 9 (see Combined Limitation instructions)

.00

4. College credit: attach Schedule CC-40 ______________________________________________

4

.00

5. Credit for taxes paid to other states: enclose other state’s return __________________________

5

6. Other Credits: See instructions (enclose additional sheets if necessary)

.00

a. Enter credit name

code no.

6a

.00

b. Enter credit name

code no.

6b

.00

c. Enter credit name

code no.

6c

.00

d. Enter credit name

code no.

6d

.00

7. Enter the total credits from Schedule IN-OCC, line 17, and enclose that schedule _____________

7

Important: Lines 4 through 7 added together cannot be greater than the state adjusted gross

income tax due on Form IT-40PNR, line 8 (see Combined Limitations instructions)

.00

8. Add lines 1 through 7. Enter total here and on line 13 of Form IT-40PNR

Total Offset Credits

8

*23914111694*

23914111694

1

1