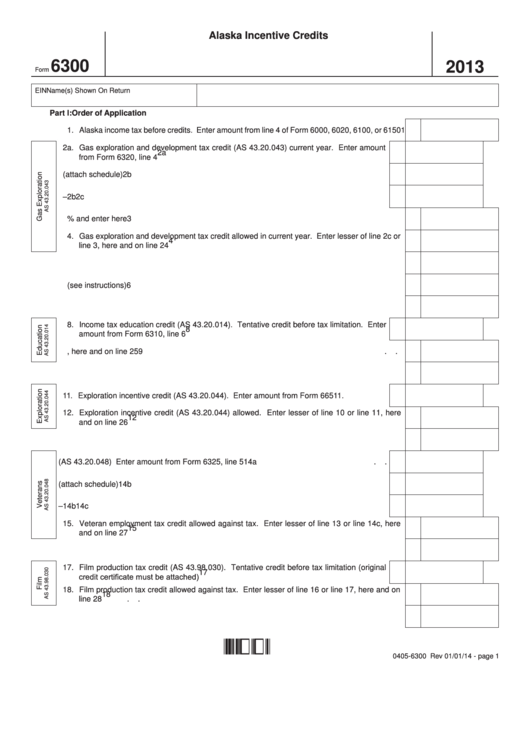

Alaska Incentive Credits

6300

2013

Form

EIN

Name(s) Shown On Return

Part I: Order of Application

1. Alaska income tax before credits. Enter amount from line 4 of Form 6000, 6020, 6100, or 6150

1

2a. Gas exploration and development tax credit (AS 43.20.043) current year. Enter amount

2a

from Form 6320, line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b. Gas exploration and development tax credit carryover (attach schedule)

2b

.

.

.

.

.

.

2c. Tentative credit before tax limitation. Add amounts on lines 2a–2b

2c

.

.

.

.

.

.

.

.

3. Multiply line 1 by 75% and enter here

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4. Gas exploration and development tax credit allowed in current year. Enter lesser of line 2c or

4

line 3, here and on line 24

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5. Subtract line 4 from line 1

5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6. Alaska other taxes (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7. Add lines 5 and 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8. Income tax education credit (AS 43.20.014). Tentative credit before tax limitation. Enter

8

amount from Form 6310, line 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9. Income tax education credit allowed. Enter lesser of line 7 or line 8, here and on line 25

9

.

.

10. Subtract line 9 from line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11. Exploration incentive credit (AS 43.20.044). Enter amount from Form 665

.

.

.

.

.

11

12. Exploration incentive credit (AS 43.20.044) allowed. Enter lesser of line 10 or line 11, here

12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

and on line 26

13. Subtract line 12 from line 10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14a. Veteran employment tax credit (AS 43.20.048) Enter amount from Form 6325, line 5

.

.

14a

14b. Veteran employment tax credit carryover (attach schedule)

.

.

.

.

.

.

.

.

.

.

14b

14c. Tentative credit before tax limitation. Add amounts on lines 14a–14b

.

.

.

.

.

.

.

14c

15. Veteran employment tax credit allowed against tax. Enter lesser of line 13 or line 14c, here

15

and on line 27

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16. Subtract line 15 from line 13

16

17. Film production tax credit (AS 43.98.030). Tentative credit before tax limitation (original

17

credit certificate must be attached)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18. Film production tax credit allowed against tax. Enter lesser of line 16 or line 17, here and on

18

line 28

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19. Subtract line 18 from line 16

19

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6300:01 01 14

0405-6300 Rev 01/01/14 - page 1

1

1 2

2