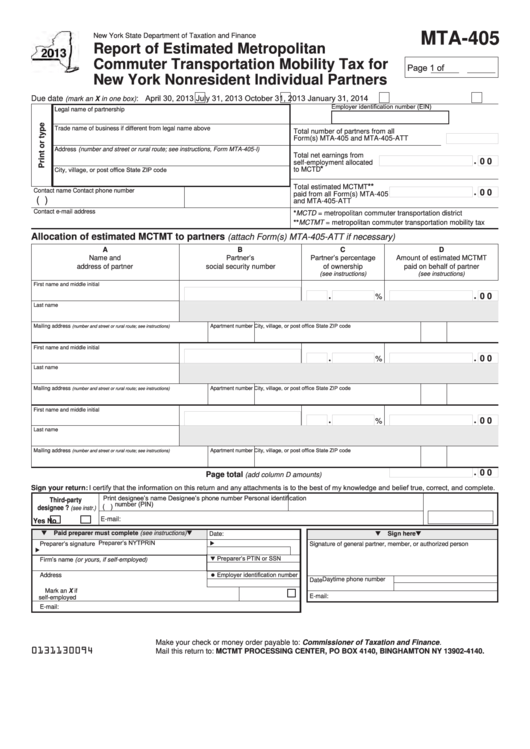

MTA-405

New York State Department of Taxation and Finance

Report of Estimated Metropolitan

Commuter Transportation Mobility Tax for

Page

1

of

New York Nonresident Individual Partners

: April 30, 2013

July 31, 2013

October 31, 2013

January 31, 2014

Due date

(mark an X in one box)

Employer identification number (EIN)

Legal name of partnership

Trade name of business if different from legal name above

Total number of partners from all

Form(s) MTA‑405 and MTA‑405‑ATT

Address (number and street or rural route; see instructions, Form MTA-405-I)

Total net earnings from

0 0

self‑employment allocated

City, village, or post office

State

ZIP code

*

to MCTD

**

Total estimated MCTMT

Contact name

Contact phone number

0 0

paid from all Form(s) MTA‑405

(

)

and MTA‑405‑ATT

Contact e‑mail address

*MCTD = metropolitan commuter transportation district

**MCTMT = metropolitan commuter transportation mobility tax

Allocation of estimated MCTMT to partners

(attach Form(s) MTA-405-ATT if necessary)

A

B

C

D

Partner’s

Partner’s percentage

Name and

Amount of estimated MCTMT

address of partner

social security number

of ownership

paid on behalf of partner

(see instructions)

(see instructions)

First name and middle initial

0 0

%

Last name

Apartment number City, village, or post office

State

ZIP code

Mailing address

(number and street or rural route; see instructions)

First name and middle initial

0 0

%

Last name

Apartment number City, village, or post office

State

ZIP code

Mailing address

(number and street or rural route; see instructions)

First name and middle initial

0 0

%

Last name

Apartment number City, village, or post office

State

ZIP code

Mailing address

(number and street or rural route; see instructions)

0 0

Page total

..............................

(add column D amounts)

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

(

)

designee ?

(see instr.)

E‑mail:

Yes

No

Paid preparer must complete (see instructions)

Date:

Sign here

Preparer’s NYTPRIN

Preparer’s signature

Signature of general partner, member, or authorized person

Preparer’s PTIN or SSN

Firm’s name (or yours, if self-employed

)

Employer identification number

Address

Daytime phone number

Date

Mark an X if

E‑mail:

self‑employed

E‑mail:

Make your check or money order payable to: Commissioner of Taxation and Finance.

0131130094

Mail this return to: MCTMT PROCESSING CENTER, PO BOX 4140, BINGHAMTON NY 13902-4140.

1

1 2

2