RESET

PRINT

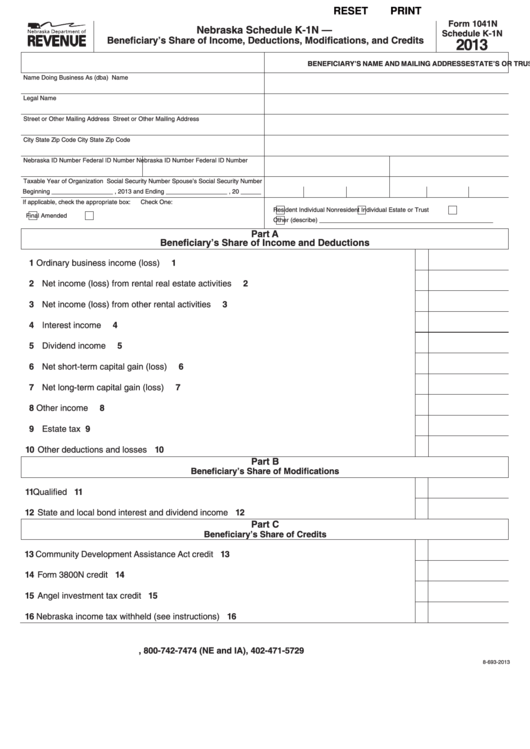

Form 1041N

Nebraska Schedule K-1N —

Schedule K-1N

Beneficiary’s Share of Income, Deductions, Modifications, and Credits

2013

ESTATE’S OR TRUST’S NAME AND MAILING ADDRESS

BENEFICIARY’S NAME AND MAILING ADDRESS

Name Doing Business As (dba)

Name

Legal Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Nebraska ID Number

Federal ID Number

Nebraska ID Number

Federal ID Number

Taxable Year of Organization

Social Security Number

Spouse’s Social Security Number

Beginning __________________ , 2013 and Ending __________________ , 20 ______

If applicable, check the appropriate box:

Check One:

Resident Individual

Nonresident Individual

Estate or Trust

Final

Amended

Other (describe) ___________________________________________________

Part A

Beneficiary’s Share of Income and Deductions

1 Ordinary business income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Net income (loss) from rental real estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Net income (loss) from other rental activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Net short-term capital gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Net long-term capital gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Estate tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Other deductions and losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Part B

Beneficiary’s Share of Modifications

11 Qualified U .S . government interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 State and local bond interest and dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Part C

Beneficiary’s Share of Credits

13 Community Development Assistance Act credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Form 3800N credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Angel investment tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Nebraska income tax withheld (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-693-2013

1

1