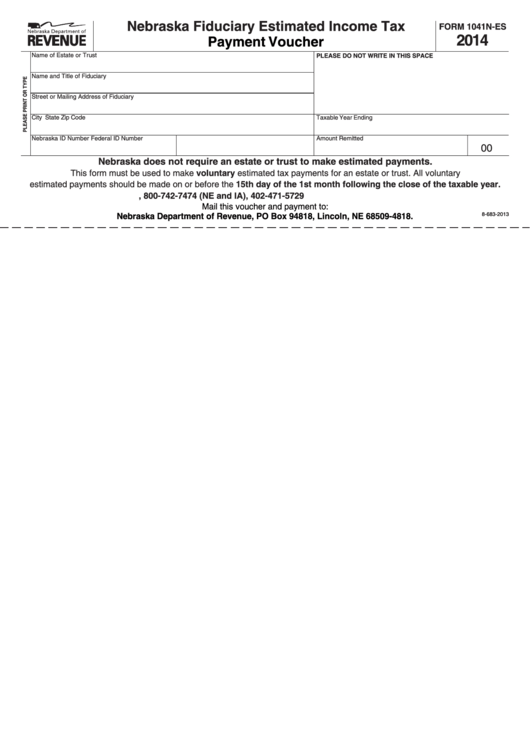

Form 1041n-Es - Nebraska Fiduciary Estimated Income Tax Payment Voucher - 2014

ADVERTISEMENT

Nebraska Fiduciary Estimated Income Tax

FORM 1041N-ES

2014

Payment Voucher

Name of Estate or Trust

PLEASE DO NOT WRITE IN THIS SPACE

Name and Title of Fiduciary

Street or Mailing Address of Fiduciary

City

State

Zip Code

Taxable Year Ending

Nebraska ID Number

Federal ID Number

Amount Remitted

00

Nebraska does not require an estate or trust to make estimated payments.

This form must be used to make voluntary estimated tax payments for an estate or trust. All voluntary

estimated payments should be made on or before the 15th day of the 1st month following the close of the taxable year.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Mail this voucher and payment to:

Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

8-683-2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1