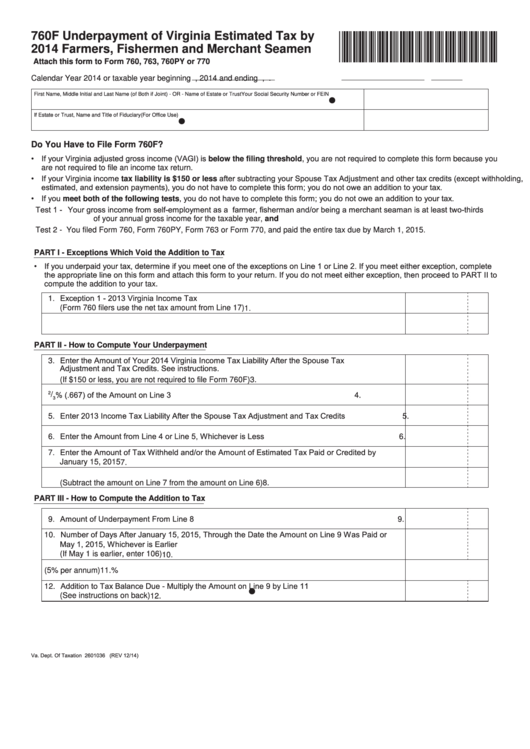

760F

Underpayment of Virginia Estimated Tax by

*VA760F114888*

2014

Farmers, Fishermen and Merchant Seamen

Attach this form to Form 760, 763, 760PY or 770

Calendar Year 2014 or taxable year beginning

, 2014 and ending

,

.

First Name, Middle Initial and Last Name (of Both if Joint) - OR - Name of Estate or Trust

Your Social Security Number or FEIN

v

If Estate or Trust, Name and Title of Fiduciary

(For Office Use)

v

Do You Have to File Form 760F?

• If your Virginia adjusted gross income (VAGI) is below the filing threshold, you are not required to complete this form because you

are not required to file an income tax return.

• If your Virginia income tax liability is $150 or less after subtracting your Spouse Tax Adjustment and other tax credits (except withholding,

estimated, and extension payments), you do not have to complete this form; you do not owe an addition to your tax.

• If you meet both of the following tests, you do not have to complete this form; you do not owe an addition to your tax.

Test 1 - Your gross income from self-employment as a farmer, fisherman and/or being a merchant seaman is at least two-thirds

of your annual gross income for the taxable year, and

Test 2 - You filed Form 760, Form 760PY, Form 763 or Form 770, and paid the entire tax due by March 1, 2015.

PART I - Exceptions Which Void the Addition to Tax

• If you underpaid your tax, determine if you meet one of the exceptions on Line 1 or Line 2. If you meet either exception, complete

the appropriate line on this form and attach this form to your return. If you do not meet either exception, then proceed to PART II to

compute the addition to your tax.

1. Exception 1 - 2013 Virginia Income Tax

(Form 760 filers use the net tax amount from Line 17)

1.

2. Exception 2 - Estimated Tax Based on 2013 Income Using 2014 Rates and Exemptions

2.

PART II - How to Compute Your Underpayment

3. Enter the Amount of Your 2014 Virginia Income Tax Liability After the Spouse Tax

Adjustment and Tax Credits. See instructions.

(If $150 or less, you are not required to file Form 760F)

3.

% (.667) of the Amount on Line 3

2

/

4. Enter 66

4.

3

5. Enter 2013 Income Tax Liability After the Spouse Tax Adjustment and Tax Credits

5.

6. Enter the Amount from Line 4 or Line 5, Whichever is Less

6.

7. Enter the Amount of Tax Withheld and/or the Amount of Estimated Tax Paid or Credited by

January 15, 2015

7.

8. Underpayment of Estimated Tax

(Subtract the amount on Line 7 from the amount on Line 6)

8.

PART III - How to Compute the Addition to Tax

9. Amount of Underpayment From Line 8

9.

10. Number of Days After January 15, 2015, Through the Date the Amount on Line 9 Was Paid or

May 1, 2015, Whichever is Earlier

(If May 1 is earlier, enter 106)

10.

11. Multiply Line 10 by the Daily Interest Rate of .00014 (5% per annum)

11.

%

12. Addition to Tax Balance Due - Multiply the Amount on Line 9 by Line 11

v

(See instructions on back)

12.

Va. Dept. Of Taxation 2601036 (REV 12/14)

1

1 2

2