Page 4 of 7 IT-2104 (1/12)

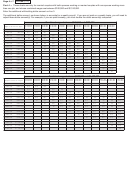

Part 4 —

These charts are only for married couples with both spouses working or married couples with one spouse working more

than one job, and whose combined wages are between $100,000 and $2,100,000.

Enter the additional withholding dollar amount on line 3.

The additional dollar amount, as shown below, is accurate for a weekly payroll. If you are not paid on a weekly basis, you will need to

adjust these dollar amount(s). For example, if you are paid biweekly, you must double the dollar amount(s) computed.

Combined wages between $100,000 and $500,000

$100,000 $120,000

$140,000

$160,000

$180,000

$220,000

$260,000

$300,000

$350,000

$400,000

$450,000

Higher earner’s wages

$120,000 $140,000

$160,000

$180,000

$220,000

$260,000

$300,000

$350,000

$400,000

$450,000

$500,000

$50,000

$70,000

$11

$15

$70,000

$90,000

$11

$16

$21

$90,000

$110,000

$7

$14

$19

$25

$32

$110,000

$120,000

$2

$9

$15

$21

$30

$29

$120,000

$130,000

$4

$12

$19

$28

$28

$130,000

$140,000

$2

$9

$16

$26

$28

$25

$140,000

$150,000

$4

$14

$23

$27

$23

$150,000

$160,000

$2

$10

$20

$25

$22

$20

$160,000

$180,000

$4

$16

$21

$22

$21

$180,000

$220,000

$6

$11

$17

$19

$17

$220,000

$260,000

$6

$11

$22

$24

$18

$17

$260,000

$300,000

$6

$17

$28

$24

$18

$300,000

$350,000

$9

$19

$25

$21

$350,000

$400,000

$7

$15

$21

$400,000

$450,000

$7

$15

$450,000

$500,000

$7

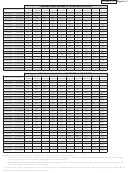

Combined wages between $500,000 and $1,100,000

$500,000 $550,000

$600,000

$650,000

$700,000

$750,000

$800,000

$850,000

$900,000

$950,000 $1,000,000 $1,050,000

Higher earner’s wages

$550,000 $600,000

$650,000

$700,000

$750,000

$800,000

$850,000

$900,000

$950,000 $1,000,000 $1,050,000 $1,100,000

$260,000

$300,000

$19

$300,000

$350,000

$14

$16

$18

$350,000

$400,000

$17

$10

$12

$14

$6

$400,000

$450,000

$21

$17

$10

$12

$14

$6

$6

$450,000

$500,000

$15

$21

$17

$10

$12

$14

$6

$6

$6

$500,000

$550,000

$7

$15

$21

$17

$10

$12

$14

$6

$6

$6

$8

$11

$550,000

$600,000

$7

$15

$21

$17

$10

$12

$14

$6

$6

$8

$11

$600,000

$650,000

$7

$15

$21

$17

$10

$12

$14

$6

$8

$11

$650,000

$700,000

$7

$15

$21

$17

$10

$12

$14

$8

$11

$700,000

$750,000

$7

$15

$21

$17

$10

$12

$15

$11

$750,000

$800,000

$7

$15

$21

$17

$10

$13

$18

$800,000

$850,000

$7

$15

$21

$17

$12

$16

$850,000

$900,000

$7

$15

$21

$19

$14

$900,000

$950,000

$7

$15

$23

$21

$950,000

$1,000,000

$7

$16

$26

$1,000,000

$1,050,000

$8

$18

$1,050,000

$1,100,000

$8

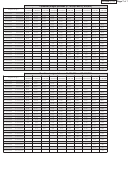

1

1 2

2 3

3 4

4 5

5 6

6 7

7