3

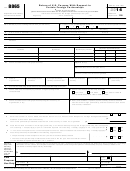

Form 8865 (2012)

Page

Schedule K

Partners' Distributive Share Items

Total amount

1

1

Ordinary business income (loss) (page 2, line 22) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Net rental real estate income (loss) (attach Form 8825) .

.

.

.

.

.

.

.

.

.

.

.

.

2

3 a Other gross rental income (loss) .

.

.

.

.

.

.

.

.

.

.

3a

b Expenses from other rental activities (attach statement)

3b

.

.

.

c Other net rental income (loss). Subtract line 3b from line 3a

.

.

.

.

.

.

.

.

.

.

.

3c

4

Guaranteed payments .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Interest income .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Dividends:

a Ordinary dividends .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Qualified dividends

.

.

.

.

.

.

.

.

.

6b

7

7

Royalties .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

8

Net short-term capital gain (loss) (attach Schedule D (Form 1065))

.

.

.

.

.

.

.

.

.

9 a Net long-term capital gain (loss) (attach Schedule D (Form 1065))

.

.

.

.

.

.

.

.

.

9a

b Collectibles (28%) gain (loss) .

.

.

.

.

.

.

.

.

.

.

.

9b

c Unrecaptured section 1250 gain (attach statement) .

9c

.

.

.

.

10

Net section 1231 gain (loss) (attach Form 4797) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Type

11

Other income (loss) (see instructions)

▶

12

12

Section 179 deduction (attach Form 4562) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13 a Contributions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13a

b Investment interest expense .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13b

(1) Type

c Section 59(e)(2) expenditures:

(2) Amount

▶

13c(2)

▶

Type

d Other deductions (see instructions)

13d

▶

14 a Net earnings (loss) from self-employment .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14a

b Gross farming or fishing income .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14b

c Gross nonfarm income .

14c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15 a Low-income housing credit (section 42(j)(5))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15a

b Low-income housing credit (other)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15b

c Qualified rehabilitation expenditures (rental real estate) (attach Form 3468) .

15c

.

.

.

.

.

.

Type

15d

d Other rental real estate credits (see instructions)

▶

Type

15e

e Other rental credits (see instructions)

▶

Type

15f

f

Other credits (see instructions)

▶

16 a Name of country or U.S. possession

▶

b Gross income from all sources

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16b

c Gross income sourced at partner level .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16c

Foreign gross income sourced at partnership level

d

e General category

f

Passive category

16f

Other (attach statement)

▶

▶

▶

Deductions allocated and apportioned at partner level

g Interest expense

h Other .

16h

.

.

.

.

.

.

.

.

.

.

.

▶

▶

Deductions allocated and apportioned at partnership level to foreign source income

i

Passive category

j General category

k

16k

▶

▶

Other (attach statement)

▶

l

16l

Total foreign taxes (check one):

Paid

Accrued

.

.

.

.

.

.

.

.

.

.

.

▶

m Reduction in taxes available for credit (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

16m

n Other foreign tax information (attach statement)

17 a Post-1986 depreciation adjustment .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17a

b Adjusted gain or loss

17b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Depletion (other than oil and gas)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17c

d Oil, gas, and geothermal properties—gross income .

.

.

.

.

.

.

.

.

.

.

.

.

.

17d

e Oil, gas, and geothermal properties—deductions .

17e

.

.

.

.

.

.

.

.

.

.

.

.

.

.

f

Other AMT items (attach statement) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17f

18 a Tax-exempt interest income .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18a

b Other tax-exempt income .

18b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Nondeductible expenses .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18c

19 a Distributions of cash and marketable securities

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19a

b Distributions of other property

19b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

20 a Investment income .

20a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Investment expenses

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

20b

c Other items and amounts (attach statement)

8865

Form

(2012)

1

1 2

2 3

3 4

4 5

5 6

6