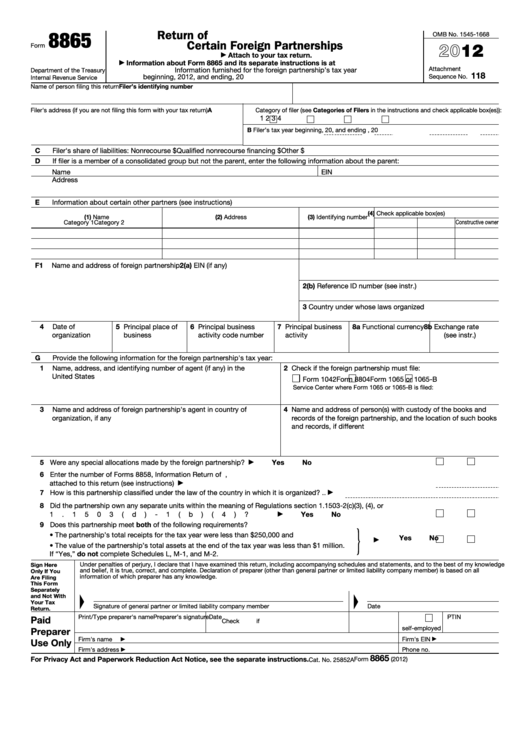

8865

Return of U.S. Persons With Respect to

OMB No. 1545-1668

Certain Foreign Partnerships

2012

Form

Attach to your tax return.

▶

Information about Form 8865 and its separate instructions is at

▶

Attachment

Information furnished for the foreign partnership’s tax year

Department of the Treasury

118

beginning

, 2012, and ending

, 20

Sequence No.

Internal Revenue Service

Filer’s identifying number

Name of person filing this return

Filer's address (if you are not filing this form with your tax return)

A Category of filer (see Categories of Filers in the instructions and check applicable box(es)):

1

2

3

4

B Filer’s tax year beginning

, 20

, and ending

, 20

C

Filer's share of liabilities: Nonrecourse $

Qualified nonrecourse financing $

Other $

D

If filer is a member of a consolidated group but not the parent, enter the following information about the parent:

Name

EIN

Address

E

Information about certain other partners (see instructions)

(4) Check applicable box(es)

(1) Name

(2) Address

(3) Identifying number

Category 1

Category 2 Constructive owner

F1

Name and address of foreign partnership

2(a) EIN (if any)

2(b) Reference ID number (see instr.)

3 Country under whose laws organized

4

5 Principal place of

6 Principal business

7 Principal business

8a Functional currency

8b Exchange rate

Date of

organization

business

activity code number

activity

(see instr.)

G

Provide the following information for the foreign partnership's tax year:

1

Name, address, and identifying number of agent (if any) in the

2 Check if the foreign partnership must file:

United States

Form 1042

Form 8804

Form 1065 or 1065-B

Service Center where Form 1065 or 1065-B is filed:

3

Name and address of foreign partnership's agent in country of

4 Name and address of person(s) with custody of the books and

organization, if any

records of the foreign partnership, and the location of such books

and records, if different

5 Were any special allocations made by the foreign partnership? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

▶

6 Enter the number of Forms 8858, Information Return of U.S. Persons With Respect To Foreign Disregarded Entities,

attached to this return (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

7 How is this partnership classified under the law of the country in which it is organized? .

.

▶

8 Did the partnership own any separate units within the meaning of Regulations section 1.1503-2(c)(3), (4), or

1.1503(d)-1(b)(4)?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

▶

9 Does this partnership meet both of the following requirements?

}

• The partnership’s total receipts for the tax year were less than $250,000 and

Yes

No

.

.

.

.

.

▶

• The value of the partnership’s total assets at the end of the tax year was less than $1 million.

If “Yes,” do not complete Schedules L, M-1, and M-2.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

Sign Here

and belief, it is true, correct, and complete. Declaration of preparer (other than general partner or limited liability company member) is based on all

Only If You

information of which preparer has any knowledge.

Are Filing

This Form

Separately

and Not With

Your Tax

Signature of general partner or limited liability company member

Date

Return.

Print/Type preparer's name

Preparer’s signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm's name

Firm's EIN

Use Only

▶

▶

Firm's address

Phone no.

▶

8865

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Form

(2012)

Cat. No. 25852A

1

1 2

2 3

3 4

4 5

5 6

6