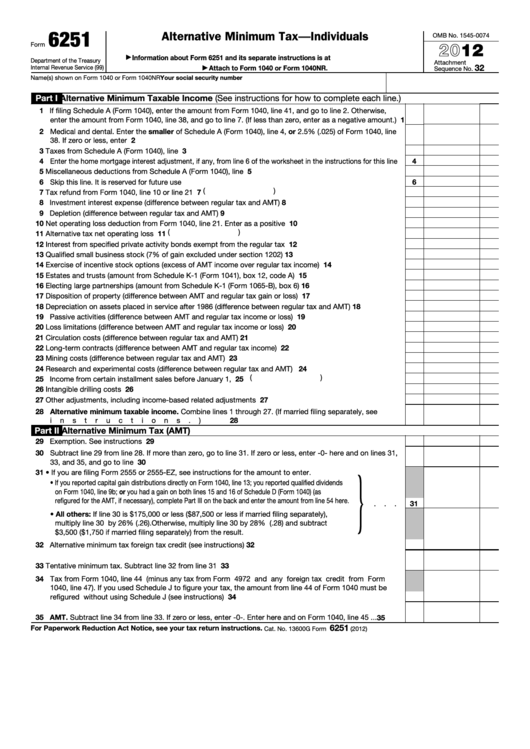

6251

Alternative Minimum Tax—Individuals

OMB No. 1545-0074

2012

Form

Information about Form 6251 and its separate instructions is at

▶

Department of the Treasury

Attachment

32

Internal Revenue Service (99)

Attach to Form 1040 or Form 1040NR.

Sequence No.

▶

Name(s) shown on Form 1040 or Form 1040NR

Your social security number

Part I

Alternative Minimum Taxable Income (See instructions for how to complete each line.)

1 If filing Schedule A (Form 1040), enter the amount from Form 1040, line 41, and go to line 2. Otherwise,

1

enter the amount from Form 1040, line 38, and go to line 7. (If less than zero, enter as a negative amount.)

2 Medical and dental. Enter the smaller of Schedule A (Form 1040), line 4, or 2.5% (.025) of Form 1040, line

38. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3 Taxes from Schedule A (Form 1040), line 9

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4 Enter the home mortgage interest adjustment, if any, from line 6 of the worksheet in the instructions for this line

4

5 Miscellaneous deductions from Schedule A (Form 1040), line 27.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 Skip this line. It is reserved for future use .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

(

)

7 Tax refund from Form 1040, line 10 or line 21

7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8 Investment interest expense (difference between regular tax and AMT).

.

.

.

.

.

.

.

.

.

.

.

8

9 Depletion (difference between regular tax and AMT)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10 Net operating loss deduction from Form 1040, line 21. Enter as a positive amount .

10

.

.

.

.

.

.

.

11 (

)

11 Alternative tax net operating loss deduction .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12 Interest from specified private activity bonds exempt from the regular tax

.

.

.

.

.

.

.

.

.

.

12

13 Qualified small business stock (7% of gain excluded under section 1202) .

13

.

.

.

.

.

.

.

.

.

.

14 Exercise of incentive stock options (excess of AMT income over regular tax income) . .

.

.

.

.

.

.

14

15 Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A)

.

.

.

.

.

.

.

.

.

15

16 Electing large partnerships (amount from Schedule K-1 (Form 1065-B), box 6) .

.

.

.

.

.

.

.

.

16

17 Disposition of property (difference between AMT and regular tax gain or loss)

17

.

.

.

.

.

.

.

.

.

18 Depreciation on assets placed in service after 1986 (difference between regular tax and AMT)

.

.

.

.

18

19 Passive activities (difference between AMT and regular tax income or loss) .

.

.

.

.

.

.

.

.

.

19

20 Loss limitations (difference between AMT and regular tax income or loss) .

20

.

.

.

.

.

.

.

.

.

.

21 Circulation costs (difference between regular tax and AMT) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

22 Long-term contracts (difference between AMT and regular tax income)

.

.

.

.

.

.

.

.

.

.

.

22

23 Mining costs (difference between regular tax and AMT)

23

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

24 Research and experimental costs (difference between regular tax and AMT) .

.

.

.

.

.

.

.

.

.

24

25 (

)

25 Income from certain installment sales before January 1, 1987

.

.

.

.

.

.

.

.

.

.

.

.

.

.

26 Intangible drilling costs preference .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

26

27 Other adjustments, including income-based related adjustments

27

.

.

.

.

.

.

.

.

.

.

.

.

.

28 Alternative minimum taxable income. Combine lines 1 through 27. (If married filing separately, see

instructions.)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

28

Part II

Alternative Minimum Tax (AMT)

29 Exemption. See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

29

30 Subtract line 29 from line 28. If more than zero, go to line 31. If zero or less, enter -0- here and on lines 31,

30

33, and 35, and go to line 34 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

}

31 • If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter.

• If you reported capital gain distributions directly on Form 1040, line 13; you reported qualified dividends

on Form 1040, line 9b; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as

refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 54 here.

.

.

.

31

• All others: If line 30 is $175,000 or less ($87,500 or less if married filing separately),

multiply line 30 by 26% (.26). Otherwise, multiply line 30 by 28% (.28) and subtract

$3,500 ($1,750 if married filing separately) from the result.

32 Alternative minimum tax foreign tax credit (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

32

33 Tentative minimum tax. Subtract line 32 from line 31 .

33

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

34 Tax from Form 1040, line 44 (minus any tax from Form 4972 and any foreign tax credit from Form

1040, line 47). If you used Schedule J to figure your tax, the amount from line 44 of Form 1040 must be

34

refigured without using Schedule J (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

35 AMT. Subtract line 34 from line 33. If zero or less, enter -0-. Enter here and on Form 1040, line 45 .

.

.

35

6251

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 13600G

Form

(2012)

1

1 2

2