Form Ct-46 - Claim For Investment Tax Credit - 2013

ADVERTISEMENT

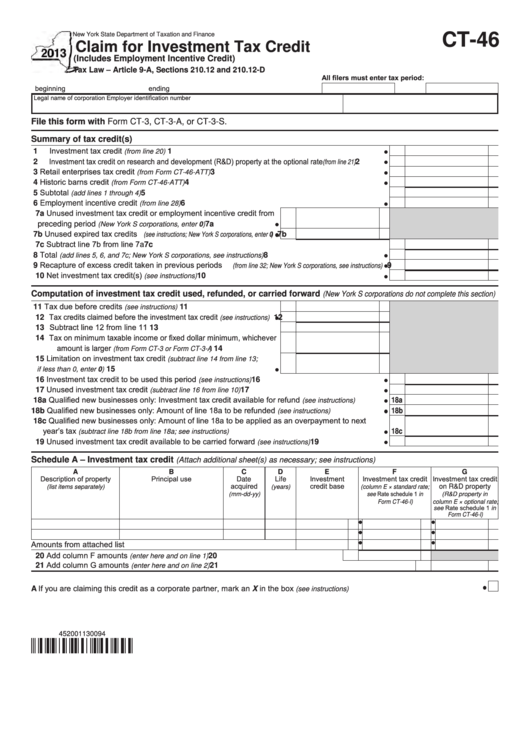

New York State Department of Taxation and Finance

CT-46

Claim for Investment Tax Credit

(Includes Employment Incentive Credit)

Tax Law – Article 9-A, Sections 210.12 and 210.12-D

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form CT-3, CT-3-A, or CT-3-S.

Summary of tax credit(s)

1 Investment tax credit

....................................................................................................

1

(from line 20)

2 Investment tax credit on research and development (R&D) property at the optional rate

...........

2

(from line 21)

3 Retail enterprises tax credit

...........................................................................

3

(from Form CT-46-ATT)

4 Historic barns credit

.......................................................................................

4

(from Form CT-46-ATT)

5 Subtotal

............................................................................................................

5

(add lines 1 through 4)

6 Employment incentive credit

........................................................................................

6

(from line 28)

7a Unused investment tax credit or employment incentive credit from

preceding period

.......................

7a

(New York S corporations, enter 0)

7b Unused expired tax credits

7b

(see instructions; New York S corporations, enter 0)

7c Subtract line 7b from line 7a .............................................................................................................

7c

8 Total

...................................................

8

(add lines 5, 6, and 7c; New York S corporations, see instructions)

9 Recapture of excess credit taken in previous periods

9

(from line 32; New York S corporations, see instructions)

10 Net investment tax credit(s)

....................................................................................

10

(see instructions)

Computation of investment tax credit used, refunded, or carried forward

(New York S corporations do not complete this section)

11 Tax due before credits

............................................ 11

(see instructions)

12 Tax credits claimed before the investment tax credit

12

(see instructions)

13 Subtract line 12 from line 11 ............................................................. 13

14 Tax on minimum taxable income or fixed dollar minimum, whichever

amount is larger

.............................. 14

(from Form CT-3 or Form CT-3-A)

15 Limitation on investment tax credit

(subtract line 14 from line 13;

.....................................................................

15

if less than 0, enter 0)

16 Investment tax credit to be used this period

...........................................................

16

(see instructions)

17 Unused investment tax credit

................................................................

17

(subtract line 16 from line 10)

18a Qualified new businesses only: Investment tax credit available for refund

............

18a

(see instructions)

18b Qualified new businesses only: Amount of line 18a to be refunded

.......................

18b

(see instructions)

18c Qualified new businesses only: Amount of line 18a to be applied as an overpayment to next

year’s tax

................................................................

18c

(subtract line 18b from line 18a; see instructions)

19 Unused investment tax credit available to be carried forward

................................

19

(see instructions)

Schedule A – Investment tax credit

(Attach additional sheet(s) as necessary; see instructions)

A

B

C

D

E

F

G

Description of property

Principal use

Date

Life

Investment

Investment tax credit

Investment tax credit

acquired

credit base

on R&D property

(list items separately)

(years)

(column E × standard rate;

see Rate schedule 1 in

(mm-dd-yy)

(R&D property in

Form CT-46-I)

column E × optional rate;

see Rate schedule 1 in

Form CT-46-I)

Amounts from attached list

20 Add column F amounts

........................................................... 20

(enter here and on line 1)

21 Add column G amounts

............................................................................................ 21

(enter here and on line 2)

A If you are claiming this credit as a corporate partner, mark an X in the box

.............................................................

(see instructions)

452001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2