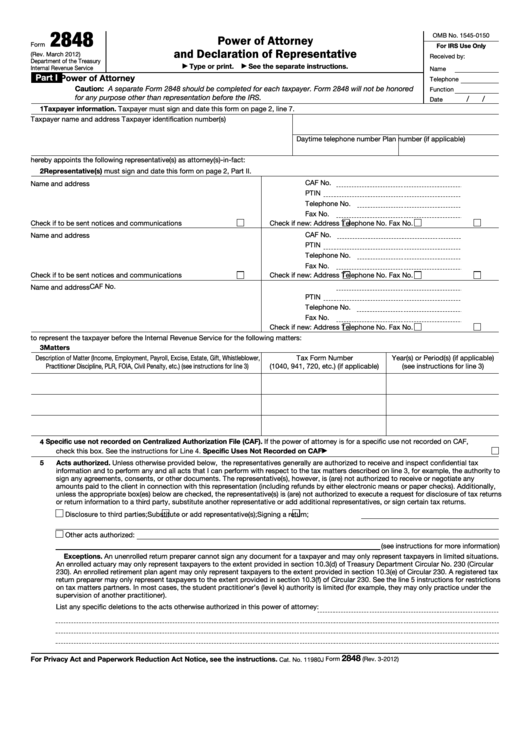

2848

OMB No. 1545-0150

Power of Attorney

Form

For IRS Use Only

and Declaration of Representative

(Rev. March 2012)

Received by:

Department of the Treasury

Type or print.

See the separate instructions.

▶

▶

Internal Revenue Service

Name

Part I

Power of Attorney

Telephone

Caution: A separate Form 2848 should be completed for each taxpayer. Form 2848 will not be honored

Function

for any purpose other than representation before the IRS.

/

/

Date

1 Taxpayer information. Taxpayer must sign and date this form on page 2, line 7.

Taxpayer name and address

Taxpayer identification number(s)

Daytime telephone number

Plan number (if applicable)

hereby appoints the following representative(s) as attorney(s)-in-fact:

2

Representative(s) must sign and date this form on page 2, Part II.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if to be sent notices and communications

Check if new: Address

Telephone No.

Fax No.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if to be sent notices and communications

Check if new: Address

Telephone No.

Fax No.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if new: Address

Telephone No.

Fax No.

to represent the taxpayer before the Internal Revenue Service for the following matters:

3

Matters

Tax Form Number

Description of Matter (Income, Employment, Payroll, Excise, Estate, Gift, Whistleblower,

Year(s) or Period(s) (if applicable)

Practitioner Discipline, PLR, FOIA, Civil Penalty, etc.) (see instructions for line 3)

(1040, 941, 720, etc.) (if applicable)

(see instructions for line 3)

Specific use not recorded on Centralized Authorization File (CAF). If the power of attorney is for a specific use not recorded on CAF,

4

check this box. See the instructions for Line 4. Specific Uses Not Recorded on CAF

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

5

Acts authorized. Unless otherwise provided below, the representatives generally are authorized to receive and inspect confidential tax

information and to perform any and all acts that I can perform with respect to the tax matters described on line 3, for example, the authority to

sign any agreements, consents, or other documents. The representative(s), however, is (are) not authorized to receive or negotiate any

amounts paid to the client in connection with this representation (including refunds by either electronic means or paper checks). Additionally,

unless the appropriate box(es) below are checked, the representative(s) is (are) not authorized to execute a request for disclosure of tax returns

or return information to a third party, substitute another representative or add additional representatives, or sign certain tax returns.

Disclosure to third parties;

Substitute or add representative(s);

Signing a return;

Other acts authorized:

(see instructions for more information)

Exceptions. An unenrolled return preparer cannot sign any document for a taxpayer and may only represent taxpayers in limited situations.

An enrolled actuary may only represent taxpayers to the extent provided in section 10.3(d) of Treasury Department Circular No. 230 (Circular

230). An enrolled retirement plan agent may only represent taxpayers to the extent provided in section 10.3(e) of Circular 230. A registered tax

return preparer may only represent taxpayers to the extent provided in section 10.3(f) of Circular 230. See the line 5 instructions for restrictions

on tax matters partners. In most cases, the student practitioner’s (level k) authority is limited (for example, they may only practice under the

supervision of another practitioner).

List any specific deletions to the acts otherwise authorized in this power of attorney:

2848

For Privacy Act and Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 3-2012)

Cat. No. 11980J

1

1 2

2