Schedule Al-Car - Alabama Secretary Of State Corporation Annual Report - 2012

ADVERTISEMENT

120005AL

BUSINESS PRIVILEGE

SCHEDULE

TAX YEAR

AL-CAR

2012

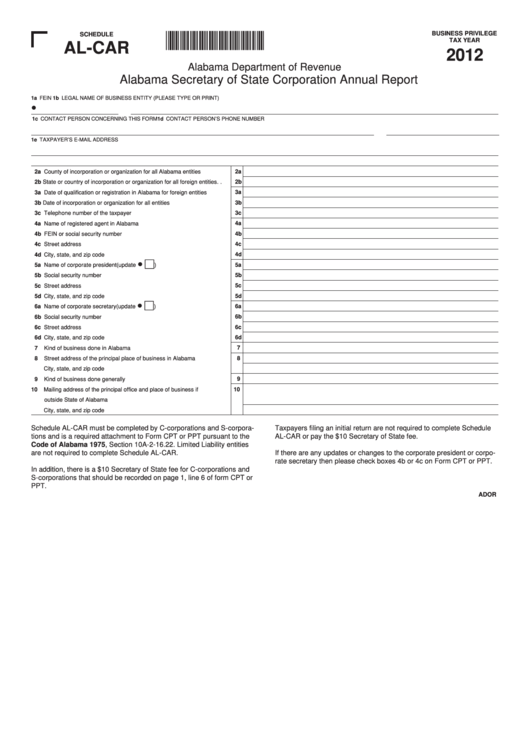

Alabama Department of Revenue

Alabama Secretary of State Corporation Annual Report

1a FEIN

1b LEGAL NAME OF BUSINESS ENTITY (PLEASE TYPE OR PRINT)

•

1c CONTACT PERSON CONCERNING THIS FORM

1d CONTACT PERSON’S PHONE NUMBER

1e TAXPAYER’S E-MAIL ADDRESS

2a

2a County of incorporation or organization for all Alabama entities. . . . . . . .

2b

2b State or country of incorporation or organization for all foreign entities . .

3a Date of qualification or registration in Alabama for foreign entities . . . . . .

3a

3b Date of incorporation or organization for all entities. . . . . . . . . . . . . . . . .

3b

3c

3c Telephone number of the taxpayer . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a Name of registered agent in Alabama. . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

4b FEIN or social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b

4c

4c Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4d City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4d

•

5a Name of corporate president . . . . . . . . . . . . . . . . . . . . . (update

)

5a

5b

5b Social security number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5c

5c Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5d City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5d

•

6a Name of corporate secretary . . . . . . . . . . . . . . . . . . . . . (update

)

6a

6b

6b Social security number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6c Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6c

6d City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6d

7

7 Kind of business done in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Street address of the principal place of business in Alabama . . . . . . . . .

8

City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Kind of business done generally. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 Mailing address of the principal office and place of business if

outside State of Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule AL-CAR must be completed by C-corporations and S-corpora-

Taxpayers filing an initial return are not required to complete Schedule

tions and is a required attachment to Form CPT or PPT pursuant to the

AL-CAR or pay the $10 Secretary of State fee.

Code of Alabama 1975, Section 10A-2-16.22. Limited Liability entities

are not required to complete Schedule AL-CAR.

If there are any updates or changes to the corporate president or corpo-

rate secretary then please check boxes 4b or 4c on Form CPT or PPT.

In addition, there is a $10 Secretary of State fee for C-corporations and

S-corporations that should be recorded on page 1, line 6 of form CPT or

PPT.

ADOR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1