Policy & Research

Phone: 785-296-3081

915 SW Harrison St

FAX: 785-296-7928

Topeka KS 66612-1588

Nick Jordan, Secretary

Department of Revenue

Sam Brownback, Governor

Richard Cram, Director

R

N

12-02

EVISED

OTICE

(November 2012)

2012 M

S

T

L

U

INERAL

EVERANCE

AX

EGISLATIVE

PDATE

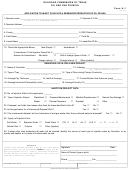

During the 2012 Legislative Session House Bill 2117 was passed and signed into law. Changes made by the

Bill affect the mineral severance tax in Kansas.

The mineral severance tax is imposed by K.S.A. 79-4217. The law in effect prior to July 1, 2012 provided an

exemption for the first 24 months of production of oil or gas from a “pool”. The term “pool” is defined in

K.S.A. 79-4217(b)(4) to mean “an underground accumulation of oil or gas in a single and separate natural

reservoir characterized by a single pressure system so that production from one part of the pool affects the

reservoir pressure throughout its extent”.

Section 29 of the Bill amends K.S.A. 79-4217(b)(4) to limit the 24 month exemption to “the severance of gas

or oil from any pool from which oil or gas was first produced on or after April 1, 1983, and prior to July 1,

2012 . . .” As a result of this language, gas or oil which is first produced on or after July 1, 2012 will not be

exempt from the mineral severance tax. There is, however, an exception to this new rule for oil production.

Section 29 of the Bill also amends K.S.A. 79-4217 to create new subsection (b)(5). This subsection provides

that, with regard to new oil pools, the 24 month exemption is available for initial production occurring on or

after July 1, 2012, but only if production from the pool does not exceed 50 barrels per day, as certified by the

Corporation Commission and the Director of Taxation. The Department is interpreting the production

limitation to be 50 barrels per well in the pool, per day. If production exceeds this limit the well will not

qualify for the exemption. The Department will base the 50 barrels per well per day calculation on the average

daily severance and production of oil for such producing well, which well has not been significantly curtailed

by reason of mechanical failure or other disruption of production, during the initial six-month production

period, commencing with the date of first production from such well. If the date of first production for a well

occurs other than the first day of the calendar month, then the average daily production calculation shall be

based on the prorated production for the first and final calendar months in that initial production period, as

necessary. For example, if the date of first production for a well in a new pool commences on August 15,

2012, the initial six-month production period shall be August 15, 2012 to February 15, 2013, and the

production for the initial and final calendar months of production in that period shall be prorated.

For any well that has qualified for this exemption, if the average daily severance and production of oil from

such well exceeds 50 barrels per day within any qualifying one-month production period after the initial

qualifying production period, the exemption for such well shall be terminated as of the commencement of

such one-month production period.

The Kansas Department of Revenue will assign a lease well number to each well that has been certified as a

new pool by the Kansas Corporation Commission. When encountering a well that has multiple formations,

each certified as a new pool, the Department requires that production be allocated separately on the Mineral

Severance Tax Report.

Section 29 of the Bill eliminates the “new pool” 24 month exemption for all new gas pools, regardless of the

amount of gas produced. There is a 24 month exemption for new oil pools, but only if oil production from the

pool does not exceed 50 barrels, per well, per day.

The notice can be found at:

3

1

1 2

2 3

3 4

4 5

5 6

6