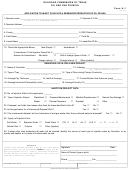

OPERATOR & PURCHASER INSTRUCTIONS

OPERATOR

To apply for a New Pool initial exemption, please complete the fields on page 1 of this form. After the Kansas

Department of Revenue approves the initial exemption, a certified copy will be sent back to you and to the

purchaser you have indicated. The certified copy will be your Certificate of Exemption.

If additional copies of this form are needed, they can only be found on the Kansas Department of Revenue’s

web site at: Due to limited state funding KDOR will not be printing

supplies of this form.

Please note that all operators and purchasers are required to notify the Mineral Tax Service Division of

any changes by submitting Form MT-8, Operator and Purchase Change Request. This form can be

submitted by email: ks.op.pur.chngrqst@kdor.ks.gov, fax: 785-296-4993 or by mail to the address on the

front of this form.

Average Daily Oil Production for Initial Production Occurring On or After 7/1/12

•

The Production History Table on page 4 of this form is

required

to be completed in order to determine

the Average Daily Production and submitted with page 1.

If the Production History Table is not

completed the Exemption Request form will be sent back to the Operator.

•

Average daily oil production is equal to total gross production divided by number of producing well days.

•

Producing well days, for a single oil well, is equal to the number of days that the well was in

production.

•

If the BOPD is greater than 50, do not send in the form because the exemption will be denied.

PURCHASER

If certified, this application informs you that the indicated lease/well is exempt for the period shown. If you

st

are not the 1

purchaser of the lease, please return the form to the Kansas Department of Revenue.

The exemption is non-transferable between operators.

Should this lease change operators, this

exemption will no longer be valid. A new exemption number for the new operator will be issued for the

remaining effective months.

If you have misplaced your copy of this application or any previous ones,

you may request Form DO-41 to obtain a copy. The form is located on the

Departments web site at: or by

phone at 785-296-4937.

2

1

1 2

2 3

3 4

4 5

5 6

6