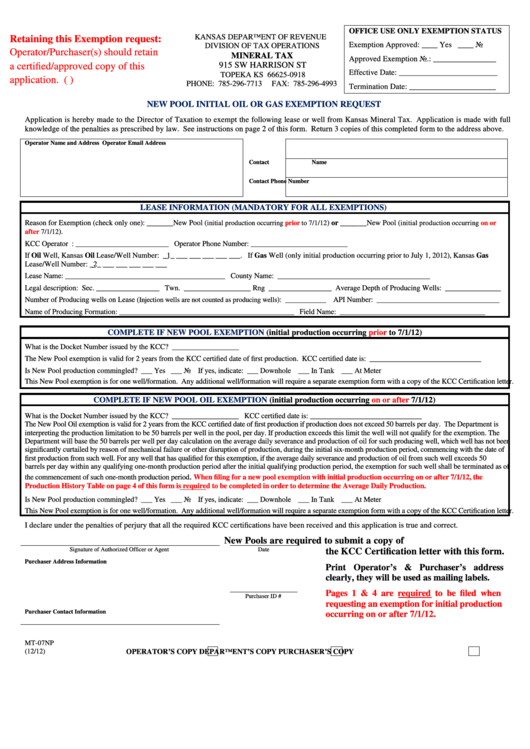

OFFICE USE ONLY EXEMPTION STATUS

KANSAS DEPARTMENT OF REVENUE

Retaining this Exemption request:

Exemption Approved: ____ Yes ____ No

DIVISION OF TAX OPERATIONS

Operator/Purchaser(s) should retain

MINERAL TAX

Approved Exemption No.: ________________

915 SW HARRISON ST

a certified/approved copy of this

Effective Date: _________________________

TOPEKA KS 66625-0918

application. (K.S.A. 79-4224)

PHONE: 785-296-7713

FAX: 785-296-4993

Termination Date: ______________________

NEW POOL INITIAL OIL OR GAS EXEMPTION REQUEST

Application is hereby made to the Director of Taxation to exempt the following lease or well from Kansas Mineral Tax. Application is made with full

knowledge of the penalties as prescribed by law. See instructions on page 2 of this form. Return 3 copies of this completed form to the address above.

Operator Name and Address

Operator Email Address

Contact Name

Contact Phone Number

LEASE INFORMATION (MANDATORY FOR ALL EXEMPTIONS)

______

______

Reason for Exemption (check only one):

New Pool (

) or

New Pool (

initial production occurring

prior

to 7/1/12

initial production occurring

on or

).

after

7/1/12

KCC Operator I.D. Number: _________________________ Operator Phone Number: __________________________

If Oil Well, Kansas Oil Lease/Well Number: _1_ ___ ___ ___ ___ ___. If Gas Well (only initial production occurring prior to July 1, 2012), Kansas Gas

Lease/Well Number: _2_ ___ ___ ___ ___ ___

Lease Name: ___________________________________________ County Name: _________________________________________

Legal description: Sec. _________________ Twn. __________________ Rng _________________ Average Depth of Producing Wells: _______________

Number of Producing wells on Lease (

Injection wells are not counted as producing wells

): ___________ API Number: _________________________________

Name of Producing Formation: _______________________________________________ Field Name: _______________________________________

COMPLETE IF NEW POOL EXEMPTION

(initial production occurring

prior

to 7/1/12)

What is the Docket Number issued by the KCC? __________________

The New Pool exemption is valid for 2 years from the KCC certified date of first production. KCC certified date is: ______________________________

Is New Pool production commingled? ___ Yes ___ No If yes, indicate: ___ Downhole ___ In Tank ___ At Meter

This New Pool exemption is for one well/formation. Any additional well/formation will require a separate exemption form with a copy of the KCC Certification letter.

COMPLETE IF NEW POOL OIL EXEMPTION

(initial production occurring

on or after

7/1/12)

What is the Docket Number issued by the KCC? __________________ KCC certified date is: ______________________________

The New Pool Oil exemption is valid for 2 years from the KCC certified date of first production if production does not exceed 50 barrels per day. The Department is

interpreting the production limitation to be 50 barrels per well in the pool, per day. If production exceeds this limit the well will not qualify for the exemption. The

Department will base the 50 barrels per well per day calculation on the average daily severance and production of oil for such producing well, which well has not been

significantly curtailed by reason of mechanical failure or other disruption of production, during the initial six-month production period, commencing with the date of

first production from such well. For any well that has qualified for this exemption, if the average daily severance and production of oil from such well exceeds 50

barrels per day within any qualifying one-month production period after the initial qualifying production period, the exemption for such well shall be terminated as of

.

When filing for a new pool exemption with initial production occurring on or after 7/1/12, the

the commencement of such one-month production period

Production History Table on page 4 of this form is required to be completed in order to determine the Average Daily Production.

Is New Pool production commingled? ___ Yes ___ No If yes, indicate: ___ Downhole ___ In Tank ___ At Meter

This New Pool exemption is for one well/formation. Any additional well/formation will require a separate exemption form with a copy of the KCC Certification letter.

I declare under the penalties of perjury that all the required KCC certifications have been received and this application is true and correct.

New Pools are required to submit a copy of

Signature of Authorized Officer or Agent

Date

the KCC Certification letter with this form.

Purchaser Address Information

Print Operator’s & Purchaser’s address

clearly, they will be used as mailing labels.

Pages 1 & 4 are required to be filed when

Purchaser ID #

requesting an exemption for initial production

Purchaser Contact Information

occurring on or after 7/1/12.

MT-07NP

(12/12)

OPERATOR’S COPY

DEPARTMENT’S COPY

PURCHASER’S COPY

1

1 2

2 3

3 4

4 5

5 6

6