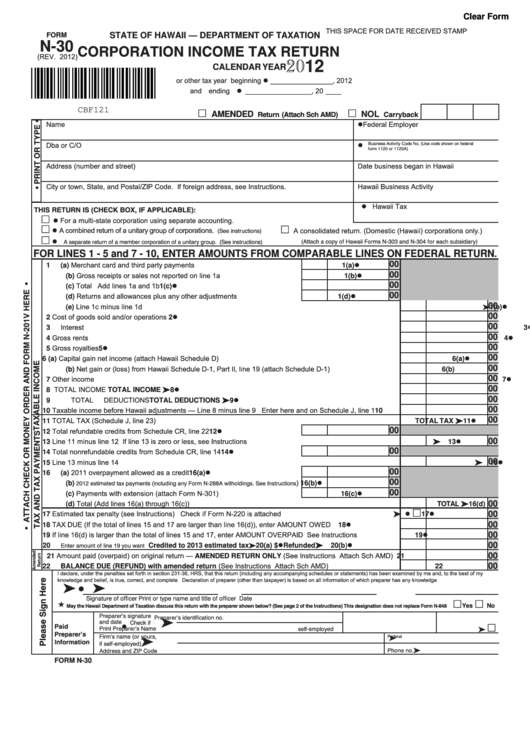

Clear Form

THIS SPACE FOR DATE RECEIVED STAMP

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

N-30

CORPORATION INCOME TAX RETURN

(REV. 2012)

2012

CALENDAR YEAR

or other tax year beginning ________________ , 2012

and ending _________________ , 20 ____

CBF121

AMENDED Return (Attach Sch AMD)

NOL Carryback

Name

Federal Employer I.D. No.

Business Activity Code No. (Use code shown on federal

Dba or C/O

form 1120 or 1120A)

Address (number and street)

Date business began in Hawaii

City or town, State, and Postal/ZIP Code. If foreign address, see Instructions.

Hawaii Business Activity

Hawaii Tax I.D. No.

THIS RETURN IS (CHECK BOX, IF APPLICABLE):

For a multi-state corporation using separate accounting.

A combined return of a unitary group of corporations. (See instructions)

A consolidated return. (Domestic (Hawaii) corporations only.)

A separate return of a member corporation of a unitary group. (See instructions)

(Attach a copy of Hawaii Forms N-303 and N-304 for each subsidiary)

FOR LINES 1 - 5 and 7 - 10, ENTER AMOUNTS FROM COMPARABLE LINES ON FEDERAL RETURN.

(a) Merchant card and third party payments

1

1(a)

00

(b) Gross receipts or sales not reported on line 1a

1(b)

00

(c) Total Add lines 1a and 1b

1(c)

00

(d) Returns and allowances plus any other adjustments

1(d)

00

(e) Line 1c minus line 1d

1(e)

00

Cost of goods sold and/or operations

2

2

00

Interest

3

3

00

Gross rents

4

4

00

Gross royalties

5

5

00

(a) Capital gain net income (attach Hawaii Schedule D)

6

6(a)

00

(b) Net gain or (loss) from Hawaii Schedule D-1, Part II, line 19 (attach Schedule D-1)

6(b)

00

Other income

7

7

00

TOTAL INCOME

8

TOTAL INCOME

8

00

TOTAL DEDUCTIONS

9

TOTAL DEDUCTIONS

9

00

Taxable income before Hawaii adjustments — Line 8 minus line 9 Enter here and on Schedule J, line 1

10

10

00

TOTAL TAX (Schedule J, line 23)

11

TOTAL TAX

11

00

Total refundable credits from Schedule CR, line 22

12

12

00

Line 11 minus line 12 If line 13 is zero or less, see Instructions

13

13

00

Total nonrefundable credits from Schedule CR, line 14

14

14

00

Line 13 minus line 14

15

15

00

(a) 2011 overpayment allowed as a credit

16

16(a)

00

(b) 2012 estimated tax payments (including any Form N-288A witholdings. See Instructions)

16(b)

00

(c) Payments with extension (attach Form N-301)

16(c)

00

(d) Total (Add lines 16(a) through 16(c))

TOTAL

16(d)

00

Estimated tax penalty (see Instructions) Check if Form N-220 is attached

17

17

00

TAX DUE (If the total of lines 15 and 17 are larger than line 16(d)), enter AMOUNT OWED

18

18

00

If line 16(d) is larger than the total of lines 15 and 17, enter AMOUNT OVERPAID See Instructions

19

19

00

20

Enter amount of line 19 you want Credited to 2013 estimated tax20(a) $

Refunded

20(b)

00

Amount paid (overpaid) on original return — AMENDED RETURN ONLY (See Instructions Attach Sch AMD)

21

21

00

BALANCE DUE (REFUND) with amended return (See Instructions Attach Sch AMD)

22

22

00

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of my

knowledge and belief, is true, correct, and complete Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge

Print or type name and title of officer

Date

Signature of officer

May the Hawaii Department of Taxation discuss this return with the preparer shown below? (See page 2 of the Instructions) This designation does not replace Form N-848

Yes

No

Preparer’s signature

Preparer’s identification no.

and date

Check if

Paid

Print Preparer’s Name

self-employed

Preparer’s

Firm’s name (or yours,

Federal

Information

E.I. No.

if self-employed)

Phone no.

Address and ZIP Code

FORM N-30

1

1 2

2