Print and Reset Form

Reset Form

STATE OF CALIFORNIA

DATA RESOURCES AND SERVICES MS A181

FRANCHISE TAX BOARD

PO BOX 1468

SACRAMENTO CA 95812-1468

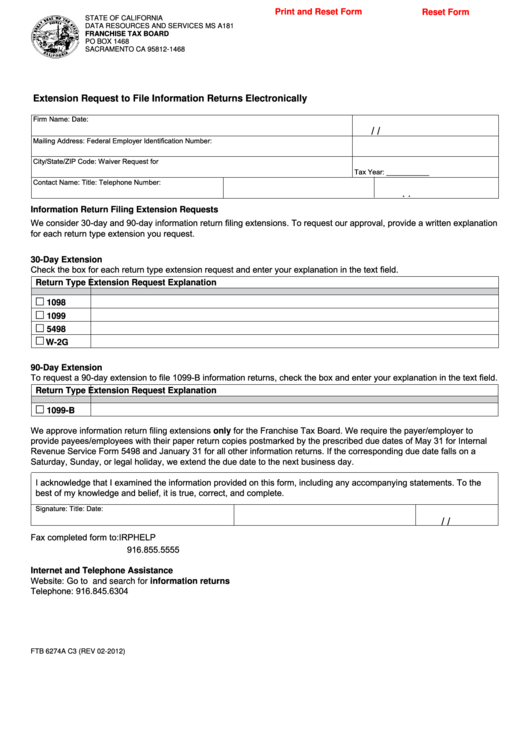

Extension Request to File Information Returns Electronically

Firm Name:

Date:

/

/

Mailing Address:

Federal Employer Identification Number:

City/State/ZIP Code:

Waiver Request for

Tax Year: ___________

Contact Name:

Title:

Telephone Number:

.

.

Information Return Filing Extension Requests

We consider 30-day and 90-day information return filing extensions. To request our approval, provide a written explanation

for each return type extension you request.

30-Day Extension

Check the box for each return type extension request and enter your explanation in the text field.

Return Type

Extension Request Explanation

m

1098

m

1099

m

5498

m

W-2G

90-Day Extension

To request a 90-day extension to file 1099-B information returns, check the box and enter your explanation in the text field.

Return Type

Extension Request Explanation

m

1099-B

We approve information return filing extensions only for the Franchise Tax Board. We require the payer/employer to

provide payees/employees with their paper return copies postmarked by the prescribed due dates of May 31 for Internal

Revenue Service Form 5498 and January 31 for all other information returns. If the corresponding due date falls on a

Saturday, Sunday, or legal holiday, we extend the due date to the next business day.

I acknowledge that I examined the information provided on this form, including any accompanying statements. To the

best of my knowledge and belief, it is true, correct, and complete.

Signature:

Title:

Date:

/

/

Fax completed form to: IRPHELP

916.855.5555

Internet and Telephone Assistance

Website:

Go to ftb.ca.gov and search for information returns

Telephone:

916.845.6304

FTB 6274A C3 (REV 02-2012)

1

1