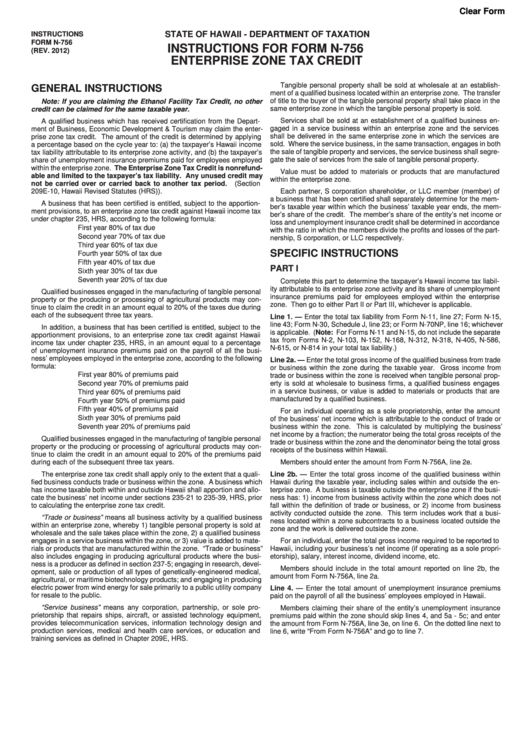

Instructions For Form N-756 Enterprise Zone Tax Credit

ADVERTISEMENT

Clear Form

INSTRUCTIONS

STATE OF HAWAII - DEPARTMENT OF TAXATION

FORM N-756

INSTRUCTIONS FOR FORM N-756

(REV. 2012)

ENTERPRISE ZONE TAX CREDIT

GENERAL INSTRUCTIONS

Tangible personal property shall be sold at wholesale at an establish-

ment of a qualified business located within an enterprise zone. The transfer

of title to the buyer of the tangible personal property shall take place in the

Note: If you are claiming the Ethanol Facility Tax Credit, no other

same enterprise zone in which the tangible personal property is sold.

credit can be claimed for the same taxable year.

Services shall be sold at an establishment of a qualified business en-

A qualified business which has received certification from the Depart-

gaged in a service business within an enterprise zone and the services

ment of Business, Economic Development & Tourism may claim the enter-

shall be delivered in the same enterprise zone in which the services are

prise zone tax credit. The amount of the credit is determined by applying

sold. Where the service business, in the same transaction, engages in both

a percentage based on the cycle year to: (a) the taxpayer’s Hawaii income

the sale of tangible property and services, the service business shall segre-

tax liability attributable to its enterprise zone activity, and (b) the taxpayer’s

gate the sale of services from the sale of tangible personal property.

share of unemployment insurance premiums paid for employees employed

within the enterprise zone. The Enterprise Zone Tax Credit is nonrefund-

Value must be added to materials or products that are manufactured

able and limited to the taxpayer’s tax liability. Any unused credit may

within the enterprise zone.

not be carried over or carried back to another tax period.

(Section

209E-10, Hawaii Revised Statutes (HRS)).

Each partner, S corporation shareholder, or LLC member (member) of

a business that has been certified shall separately determine for the mem-

A business that has been certified is entitled, subject to the apportion-

ber’s taxable year within which the business’ taxable year ends, the mem-

ment provisions, to an enterprise zone tax credit against Hawaii income tax

ber’s share of the credit. The member’s share of the entity’s net income or

under chapter 235, HRS, according to the following formula:

loss and unemployment insurance credit shall be determined in accordance

First year

80% of tax due

with the ratio in which the members divide the profits and losses of the part-

Second year

70% of tax due

nership, S corporation, or LLC respectively.

Third year

60% of tax due

SPECIFIC INSTRUCTIONS

Fourth year

50% of tax due

Fifth year

40% of tax due

PART I

Sixth year

30% of tax due

Seventh year

20% of tax due

Complete this part to determine the taxpayer’s Hawaii income tax liabil-

ity attributable to its enterprise zone activity and its share of unemployment

Qualified businesses engaged in the manufacturing of tangible personal

insurance premiums paid for employees employed within the enterprise

property or the producing or processing of agricultural products may con-

zone. Then go to either Part II or Part III, whichever is applicable.

tinue to claim the credit in an amount equal to 20% of the taxes due during

each of the subsequent three tax years.

Line 1. — Enter the total tax liability from Form N-11, line 27; Form N-15,

line 43; Form N-30, Schedule J, line 23; or Form N-70NP, line 16; whichever

In addition, a business that has been certified is entitled, subject to the

is applicable. (Note: For Forms N-11 and N-15, do not include the separate

apportionment provisions, to an enterprise zone tax credit against Hawaii

tax from Forms N-2, N-103, N-152, N-168, N-312, N-318, N-405, N-586,

income tax under chapter 235, HRS, in an amount equal to a percentage

N-615, or N-814 in your total tax liability.)

of unemployment insurance premiums paid on the payroll of all the busi-

ness’ employees employed in the enterprise zone, according to the following

Line 2a. — Enter the total gross income of the qualified business from trade

formula:

or business within the zone during the taxable year. Gross income from

First year

80% of premiums paid

trade or business within the zone is received when tangible personal prop-

Second year

70% of premiums paid

erty is sold at wholesale to business firms, a qualified business engages

in a service business, or value is added to materials or products that are

Third year

60% of premiums paid

manufactured by a qualified business.

Fourth year

50% of premiums paid

Fifth year

40% of premiums paid

For an individual operating as a sole proprietorship, enter the amount

Sixth year

30% of premiums paid

of the business’ net income which is attributable to the conduct of trade or

Seventh year

20% of premiums paid

business within the zone. This is calculated by multiplying the business’

net income by a fraction; the numerator being the total gross receipts of the

Qualified businesses engaged in the manufacturing of tangible personal

trade or business within the zone and the denominator being the total gross

property or the producing or processing of agricultural products may con-

receipts of the business within Hawaii.

tinue to claim the credit in an amount equal to 20% of the premiums paid

during each of the subsequent three tax years.

Members should enter the amount from Form N-756A, line 2e.

Line 2b. — Enter the total gross income of the qualified business within

The enterprise zone tax credit shall apply only to the extent that a quali-

fied business conducts trade or business within the zone. A business which

Hawaii during the taxable year, including sales within and outside the en-

has income taxable both within and outside Hawaii shall apportion and allo-

terprise zone. A business is taxable outside the enterprise zone if the busi-

cate the business’ net income under sections 235-21 to 235-39, HRS, prior

ness has: 1) income from business activity within the zone which does not

to calculating the enterprise zone tax credit.

fall within the definition of trade or business, or 2) income from business

activity conducted outside the zone. This term includes work that a busi-

“Trade or business” means all business activity by a qualified business

ness located within a zone subcontracts to a business located outside the

within an enterprise zone, whereby 1) tangible personal property is sold at

zone and the work is delivered outside the zone.

wholesale and the sale takes place within the zone, 2) a qualified business

engages in a service business within the zone, or 3) value is added to mate-

For an individual, enter the total gross income required to be reported to

rials or products that are manufactured within the zone. “Trade or business”

Hawaii, including your business’s net income (if operating as a sole propri-

also includes engaging in producing agricultural products where the busi-

etorship), salary, interest income, dividend income, etc.

ness is a producer as defined in section 237-5; engaging in research, devel-

Members should include in the total amount reported on line 2b, the

opment, sale or production of all types of genetically-engineered medical,

amount from Form N-756A, line 2a.

agricultural, or maritime biotechnology products; and engaging in producing

Line 4. — Enter the total amount of unemployment insurance premiums

electric power from wind energy for sale primarily to a public utility company

for resale to the public.

paid on the payroll of all the business’ employees employed in Hawaii.

“Service business” means any corporation, partnership, or sole pro-

Members claiming their share of the entity’s unemployment insurance

prietorship that repairs ships, aircraft, or assisted technology equipment,

premiums paid within the zone should skip lines 4, and 5a - 5c; and enter

provides telecommunication services, information technology design and

the amount from Form N-756A, line 3e, on line 6. On the dotted line next to

production services, medical and health care services, or education and

line 6, write “From Form N-756A” and go to line 7.

training services as defined in Chapter 209E, HRS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2